Where Can I Apply for Second Round of PPP?

Here’s an overview of where you can apply for second round of PPP, if you’re self employed – along with a breakdown of how to apply for PPP 2.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

Is There a Second Round of PPP Loans?

The Paycheck Protection Program is back for another round. Also known as PPP, this second round is available both to people who already got the first round and those who didn’t get the first round.

To be clear, you can apply if this is your first time, and this is called a First Draw PPP Loan. You can also apply and get a second round of funding in addition to your first PPP loan, and this is called a Second Draw PPP Loan.

Remember, the PPP is a forgivable loan for business owners impacted by COVID-19. If you use it for approved payroll and business expenses, it will be forgiven 100%. You won’t have to pay back any money or interest once the SBA approves your forgiveness application.

Who Qualifies for Second PPP?

If you earned self-employed income and were in business before February 15, 2020, then you might qualify for a PPP loan. I go into detail all about the basics of PPP loans and how to pay yourself PPP money, so be sure to review those posts to help you understand the details.

You do not need to have an LLC. Rather, this is available to sole proprietorships, independent contractors, gig workers, etc. If you have a partnership, S-Corp, C-Corp, or LLC, you can apply too.

You need documentation to prove payroll and expenses. The easiest documentation to use is your 2019 tax return. Second Draw PPP loans require additional documentation to prove a 25% revenue reduction when comparing your 2020 income to 2019.

Can I Apply for PPP Twice?

The maximum amount a self-employed person can get for a PPP loan is $20,833. This amount is calculated using average monthly payroll determined by a specific SBA calculation. I made this free spreadsheet to help you determine your “Correct PPP Loan Amount” so feel free to sign up for a copy.

If approved, the money can be used as owner’s compensation for those who file a Schedule C. Essentially, this means you get to pay yourself 100% of the loan when you choose the 24-week covered period. There’s also a list of approved business expenses that I detail in this video.

A few things to keep in mind. If you made more than $100,000 on Line 31 of your Schedule C, then your PPP loan amount is capped using that $100,000 figure. This means the maximum PPP loan amount a self-employed individual with no employees can get is $20,833.

You are not eligible for a PPP loan if your Schedule C shows a loss instead of a profit.

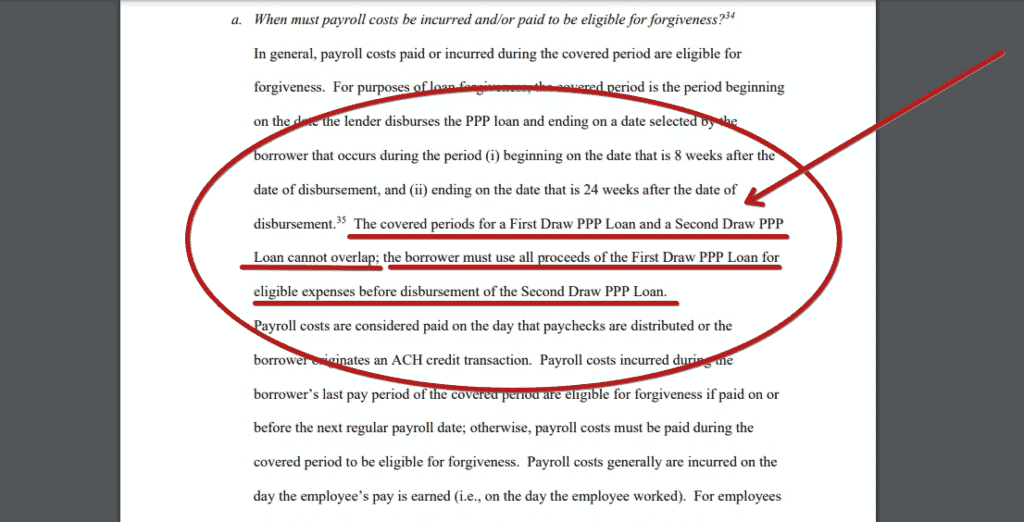

If you got the correct amount for the first round, then you can expect a similar amount for the second round. For someone applying for the first draw, you can try to get a second draw once you use all the funds from the first draw. However, the covered periods for a First Draw PPP and a Second Draw PPP Loan cannot overlap.

There are eligibility requirements to keep in mind for both the First Draw and Second Draw. For example, getting a second PPP loan requires you show a 25% loss in 2020 compared to 2019. However, the SBA does not require this documentation when you apply. Instead, they say you’re going to need it when you apply for forgiveness.

While lenders aren’t required to collect this documentation when you apply for the Second Draw PPP, some are requesting it to be proactive. It’s okay to give them your “good faith” records such as tax forms or, if relevant tax forms are not available, a copy of your quarterly income statements or bank statements.

One interesting item is that you can use 2020 tax returns or 2019 tax returns to calculate your average monthly payroll. This means that if you earned more in 2020 but can still show that 25% loss in one quarter, then you can use 2020 to calculate your second PPP loan amount. Basically, use the year that in your favor for the Second Draw PPP Loan.

Those considering a First Draw PPP Loan will need their 2019 Schedule C when applying. I also include a list of other documents to gather down below.

Can You Get 2nd PPP Loan with a Different Lender?

You do NOT need to apply for this second round with the same lender. Many felt frustrated or dissatisfied with lenders who were unable to answer questions about the loan and forgiveness process.

I heard from countless people who were upset that the big banks prioritized big businesses. It was also common for lenders to require you had a preexisting business banking relationship with them to apply for a PPP loan.

This second time around you can apply with a different lender … the decision is completely up to you. Also, it’s free to apply for a PPP loan, so ignore anyone suggesting otherwise.

I did a step by step video on how to apply if this is your first time, so use that as a guide when applying.

My overview video on applying for the Second Round PPP Loan can be found here, and I have many more resources planned as soon as the SBA provides more guidance.

I suggest gathering all the following, so you are prepared when applying for your PPP loan:

- Driver’s License—copy of front and back

- Void Check (image must show the check horizontally)

- NAICS Code for your business type

- February 2020 Bank Statement or other proof of business

- 1040 Schedule C from 2019 or 2020

It’s also a very good idea to open a new bank account for the purpose of crystal-clear records and documentation. You can transfer the entire PPP deposit into this new account, then pay yourself the money. This creates clean documentation and bank statements that will be used when you apply for forgiveness.

Many have muddy transactional records where personal and business money is co-mingled. This is not a good idea for your PPP loan. I used a high interest savings account with CIT bank for the first round, and another option is a free money account with SoFi Money—right now, they give you $50 when you open a free account.

You can get started by applying for your PPP loan right here.

As always, I’m Rich and until next time.

Listen to Teacher Millionaires Podcast

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”

Hi Rich, how are you? I’d like to know if I’m just now starting out my business, and file Single on my taxes, would that disqualify me? Also, in year 2019 I did start a small business, but discontinued it.

The guidance is that you must have been in business by Feb 2020 and still in business to qualify.

Are eligible to apply for ppp loan if you have a job?

What happens if I got approved for $10k total, $5k each round? Would I divide it by 10 weeks and pay myself $1k each week?

Yes, you got it.

Can you apply for the 2nd draw before you have used all of the first draw? Womply sent me the 2nd one a week later. I’m just now hearing you can’t apply for the 2nd draw until the first one is spent. If you do it won’t be forgiven. Is this true? Thanks for your time.

Also Harvest loan number isn’t on the PN just the SBA # is this the same number we use to apply for forgiveness. How can we get the loan number if needed. Harvest can’t be reached very well.