How to Apply for Employee Retention Credit

I can’t believe more people aren’t talking about how to apply for Employee Retention Credit ERC. This tax credit is available to many business owners who have W2 employees. Up to $26,000 per employee is available in a tax credit that goes directly towards your business.

I’m going to share with you exactly how to calculate the amount your business might get and how to apply for the Employee Retention Credit. I also wrote a deep-dive blog post that explains the basics of the Employment Retention Credit that you can read here.

This post and the images below walk you step-by-step through the process to see exactly how much ERC you potentially qualify for. Also, my partners at the ERC Specialists can help take care of all the necessary IRS paperwork, so you get your money quickly.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

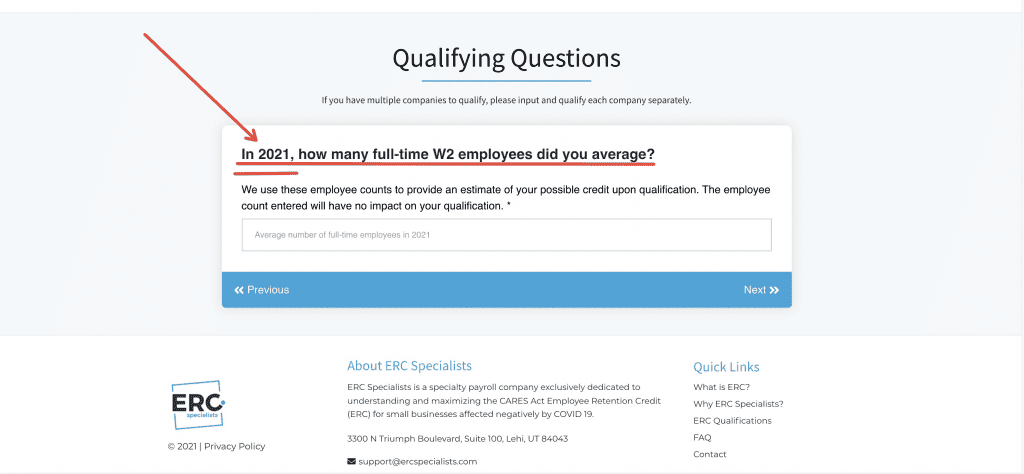

Employee Retention Credit ERC Qualifying Questions

Below is what the homepage looks like for the ERC Qualifying Questions. The amount of your tax credit is based on your payroll documents and gross receipts for 2019, 2020, and 2021. It’s a good idea to gather the following information about your business before you begin these ERC Qualifying Questions:

- Full-time employee average for 2019 – a full-time employee is considered someone that works 30+ hrs per week.

- Gross receipts for each quarter of 2019, 2020, and 2021 (total deposits/sales NOT including PPP funds).

- Be ready to answer questions about government shutdowns that impacted your business. An example of a qualified government shutdown would be if your vendors experienced shutdowns and you couldn’t obtain critical goods.

Related video content: Employee Retention Credit and PPP

Next, if you are a business that has W2 employees where you run payroll, then go ahead and click YES. If you do not have W2 employees, then unfortunately you don’t qualify for this tax credit.

The following question asks when you started your business. The two options are “Before February 15, 2020” and “After February 15, 2020.” The ERC tax credit is available to nearly all businesses who were up and running at some time during the COVID-19 pandemic. Select the date that applies for your business.

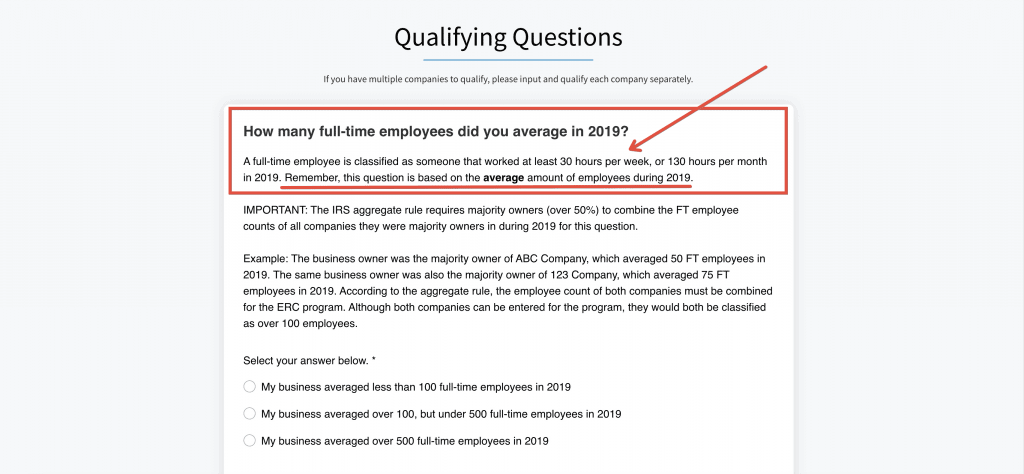

You also need to input the number of full-time employees you averaged in 2019. There are some nuances when your business has over 100 full-time employees or over 500 full-time employees. Just remember this question is based on the average number of employees during 2019, and a full-time employee is considered someone that works at least 30 hours per week or 130 hours per month.

[elementor-template id=”6232″]

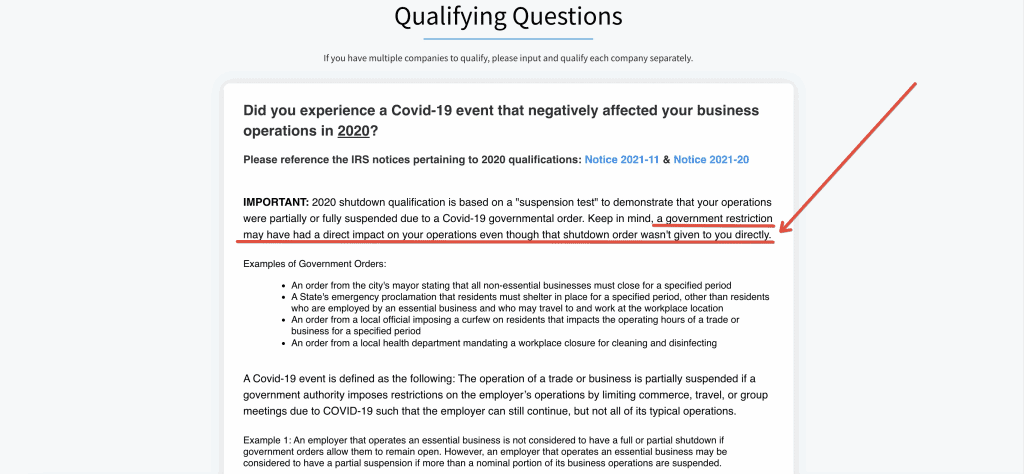

The following is one of the easiest ERC Qualifying Questions I can think of, “Did you experience a COVID-19 event that negatively affected your business operations in 2020?”

Pretty much every single business was at least partially or fully shutdown at some point during the pandemic. Of course, the language in these ERC Qualifying Questions is new for all of us, so let’s take a look at what qualifies as a COVID-19 event.

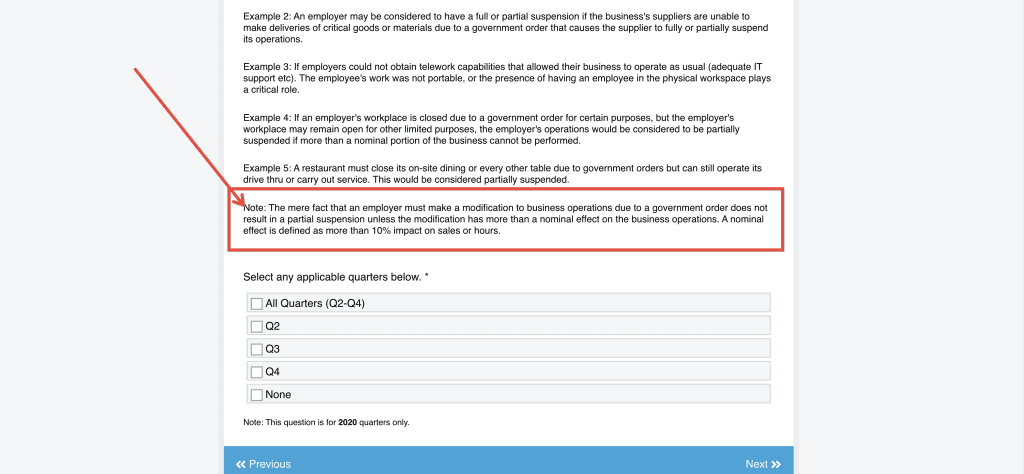

A COVID-19 event means that your trade or business was partially or fully shutdown because of government restrictions or government mandates. The ERC Specialists provide several different examples of companies impacted by a COVID-19 event to help you better understand. As you can see from the image below, many businesses will probably qualify because of the widespread impact of COVID-19.

Moving along, they ask about the number of full-time W2 employees you averaged during 2020. This number helps provide an estimate of your possible ERC tax credit but has no impact on whether or not you qualify.

Then, they ask about 2021 and if your business was negatively affected by COVID-19. Select the boxes for each Quarter of 2021 (from Quarters 1-3) in which your business was negatively affected by a COVID-19 event.

Just to be clear, if your gross revenue (all the money you brought in) was drastically down in 2020 or 2021 compared to 2019, then you’re probably going to meet the qualifications for this tax credit very easily.

[elementor-template id=”6189″]

For example, the next prompt wants to know about Q1 2021 gross revenue being at least 20% lower than Q1 2019 (or Q1 2020 if not in business in Q1 2019). For the sake of this example, I selected “No” so you can see that the application will continue, even without a gross revenue decrease, and you might still qualify for ERC money.

Answering “No” triggers an “Alternative Quarter Qualifier” question. Since (in the previous question) we answered that we did NOT have a 20% reduction in Q1 2021 compared to Q1 of 2019, we are now being asked if revenue in Q4 of 2020 was 20% lower than in Q4 of 2019.

For the sake of keeping this post straightforward and consistent, I again selected “No.”

Next is a similar question but for Q2 of 2021. And again for Q3 of 2021.

As of now, ERC is not available for Q4 of 2021.

Then, they ask how many full-time W2 employees did you have on payroll on average in 2021? They are NOT talking about 1099 workers or people paid under the table. Again, the IRS counts full-time employees as 30 hours or more per week.

Unfortunately, similar to previous requirements, this number does not include immediate family members and relatives. You should only count W2, full-time employees that are NOT related to you and who don’t own part of the business.

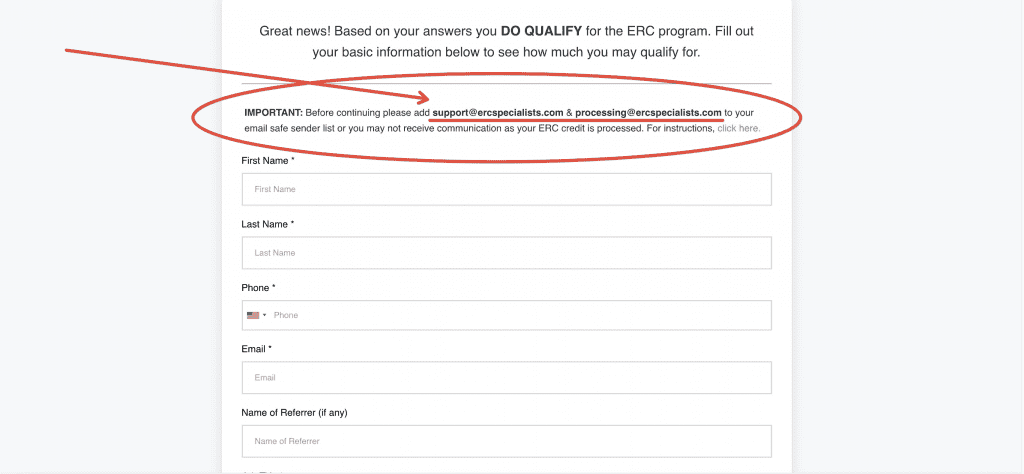

Depending on all your answers, you hopefully come to this screen that tells you “Great news! Based on your answers you DO QUALIFY for the ERC program.”

After, you must fill out basic contact and business information such as your personal contact information along with business name and address. The ERC Specialists do not require a copy of your taxes or your social security number, but you need to gather and upload specific payroll documents.

One helpful tip is to add the specific email addresses from ERC specialists support@ercspecialists.com & processing@ercspecialists.com to your email safe-sender list so that followup emails don’t go to your spam folder.

You might also like: Better Than PPP | Employee Retention Credit

Also, they ask for the name of the referrer, so feel free to write “Rich Smith” which helps me and is no extra cost to you. In fact, there are NO upfront costs for you. The ERC Specialists fee is a percentage of the funds you are paid OR if you decide to pre-pay, the fees that the ERC Specialists take are even less.

Moving on, the next screen shows your estimated potential ERC tax credits. Remember, this is an estimate – your actual numbers could be higher or lower.

For the sake of this example, I wrote an average of 10 full-time W2 employees. My example qualifies for an estimated $40,000 in 2020 – that’s about $4,000 per employee for 2020. And for 2021, an estimated $38,500 per quarter for a total of $115,500 for a company with about 10 full-time employees for 2021.

Later, you must upload a detailed payroll report. You need one from March 13, 2020 – September 30, 2021. There’s also an option to select your Payroll Provider. Remember to include all the wages paid and anything your business paid out such as healthcare.

Some common questions about payroll, wage payments, and deductions:

- What constitutes a payment? Anything you pay out to an employee is a payment. It could be tips, wages, salary, other forms of compensation, stipends, and allowances. All of it counts.

- What are deductions? Any deductions you took should be on the detailed payroll report. The ERC Specialists need to know amounts for items such as health insurance, dental insurance, life insurance, child support, etc.

- Can I just give the ERC Specialists access to my payroll provider? Yes, if you are feeling confused or overwhelmed, then you can give online access to your payroll provider. For example, my payroll provider is Gusto, so I can easily give limited-admin access so the ERC Specialists can get the reports required.

Once you have your detailed payroll report in PDF form, then upload and submit.

The last few items needed are names of any relatives or majority owners that are excluded from the tax credit. You will need to list their names to complete your ERC Qualifying Questions.

You also need to upload 941 Forms for all quarters of 2020 and the first 3 quarters of 2021. These are payroll forms that are filed with the IRS quarterly. You may not even know 941 forms exist if your payroll company files them for you, so I recommend you ask your payroll company for these forms directly.

Lastly, they ask about Paycheck Protection Program PPP loans. The reason is because there’s no “double-dipping” of funds used for payroll.

For example, if you qualify for this tax credit for the first quarter of 2021, but you got PPP and paid your employees during that same quarter with PPP funds, then they’re not going to give you more government money … remember to be honest and let them know if you used PPP funds for your business.

RELATED CONTENT: How to Pay Yourself PPP Loan Self-Employed

How Long Does It Take to Get Employee Retention Credit Refund?

My advice is to not drag your feet on applying for the ERC tax credit – IRS processing times can be 16 weeks or longer before you get your money.

While the ERC Specialists work fast, it can be a bit of a waiting game with the IRS. Therefore, be persistent and get your detailed payroll report and 941 forms from your payroll company, so you can get in line for all the money coming your way.

Honestly, I am shocked more people aren’t talking about this ERC tax credit.

It’s an opportunity for companies affected by COVID-19 to get financial help. If you still have any ERC questions, then leave a comment below, or I am available for one-on-one consultations. We can crunch your numbers and run through these ERC Qualify Questions together.

[elementor-template id=”4878″]

Listen to Teaching Millionaires Podcast

As always, I’m Rich and until next time.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”