Next Short Squeeze Stocks

Here’s an overview of why short squeeze investing has become popular – and breakdown of the next short squeeze stocks.

“teachingmillionaires.com has partnered with CardRatings for our coverage of credit card products. teachingmillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

How Does Short Selling a Stock Work?

September 2019, Reddit users noticed Wall Street hedge funds were shorting GameStop stock. This means these hedge funds were betting that the stock would go down in price. Then, at some point the future, they’re going to have to buy the stock to cover their bet—this is how short selling a stock works.

Their hope is that the price of the stock goes down, so they could buy it at a cheaper price. Then, they pay back what they owe and make money on the difference.

Shorting stocks is a risky way to invest. It involves essentially gambling that a company is going to fail. The fact this type of news is being covering by the mainstream media makes it an opportunity for all of us to learn more about how the stock market works.

What Happens to a Stock After a Short Squeeze?

These Reddit groups noticed the possibility of a short squeeze on GameStop stock. The term “short squeeze” means that as prices begin to rise, all those people who have short positions get squeezed to close out their positions. This means they buy the stock at a higher price than what they bet.

When this happens, those people who had short positions lose money. As a result, the price of the stock itself is driven up higher and higher when those short positions sell. This short squeeze creates an opportunity for those holding the stock to make money because the stock price increases.

The idea of a short squeeze against the hedge funds shorting GameStop went viral January 2021. Reddit, TikTok, YouTube, and eventually mainstream media, excited many people to want to buy shares of GameStop. The higher the stock price went, the more money the hedge funds lost.

Why Did Robinhood Stop Trading GameStop?

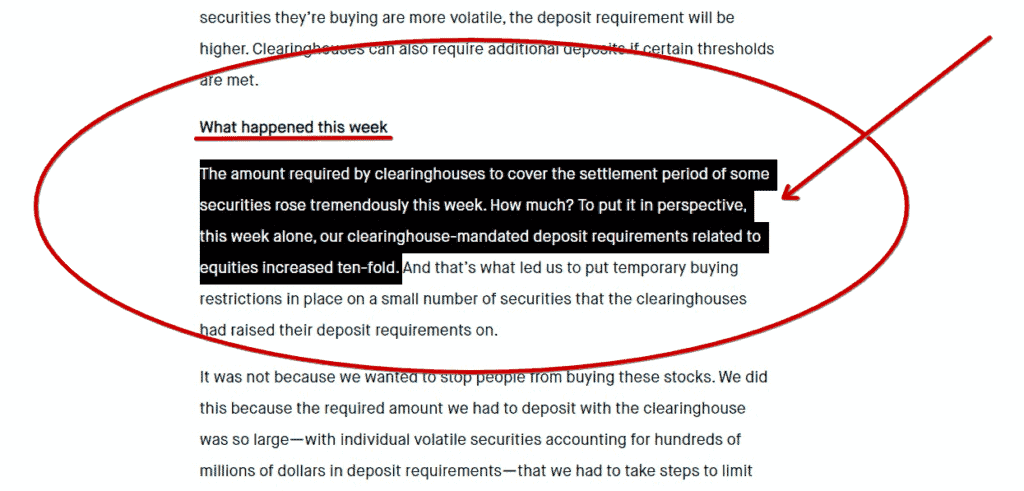

When news of the GameStop short squeeze went viral, Robinhood restricted buying of GameStop stock. In fact, the ticker symbol for GameStop GME was taken off the Robinhood app. Essentially, everyday investors like me and you weren’t allowed to buy any more.

Some are calling this market manipulation. Robinhood released statements that these restrictions were necessary so they could gather capital to cover their collateral at the clearinghouses. Their claim was regulatory requirements forced them to stop GameStop buying.

These limitations remained in place for a few days on Robinhood. However, as of this writing, those limitations have been lifted. Robinhood CEO Vlad Tenev has done multiple interviews attempting to explained what happened and is expected to testify in front of a U.S. House committee later this month.

What Stocks are Shorted the Most?

If this short squeeze mentality continues, then the GameStop investing community is going to be looking for the next short squeeze stocks.

You may have already started to hear stories of people buying AMC, Dogecoin, and Silver. The purpose of this article is to present an investing experiment. I am going to pick 10 stocks that are all heavily shorted right now under $10.

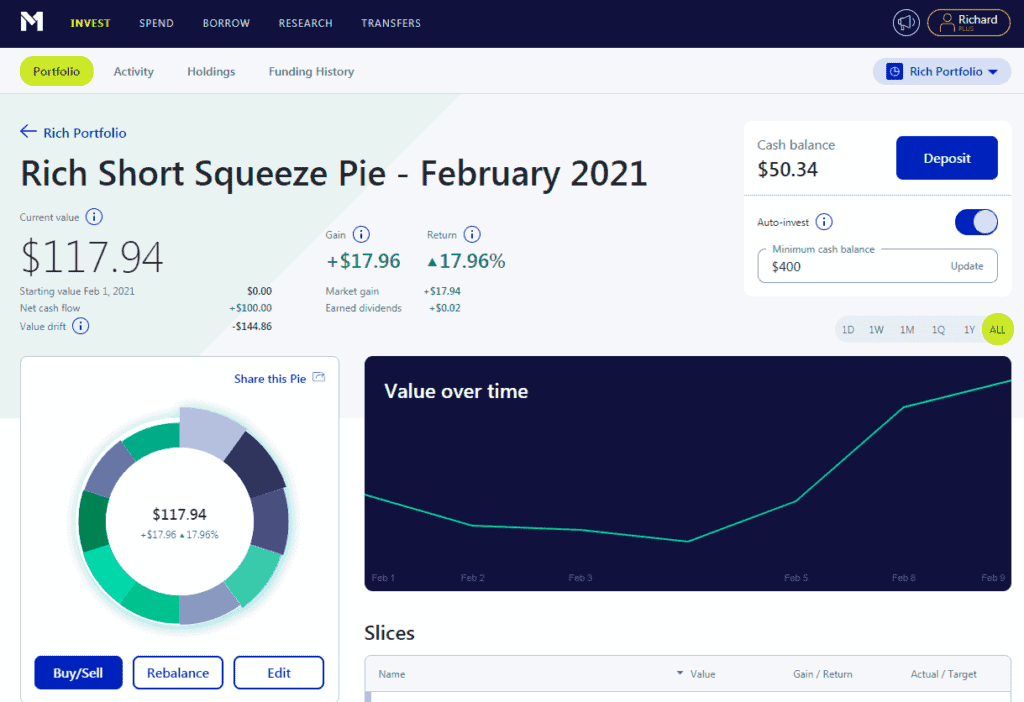

My plan is to buy an equal share of each of these 10 stocks to create a 100% portfolio on M1 Finance.

Personally, I do not think this is the best investment strategy. Maybe I’ll make a little bit of money, but I also have the potential of losing money. This “gambling” approach to investing is what I plan to track over time.

I am more of an index fund investor long-term, and I have a portion of my net worth in real estate and some cryptocurrencies including Bitcoin and Ethereum.

Here’s my top 10 list of the next short squeeze stocks under $10:

- Clovis Oncology Inc CLVS – a biopharmaceutical company that focuses on anti-cancer agents worldwide.

- Dynavax Technologies Corp. DVAX – a biopharmaceutical company that focuses on immune response stimulation.

- Kindred Biosciences Inc KIN – a biopharmaceutical company that develops biologics focused on the lives of pets.

- Lannett Co., Inc. LCI – develops, manufactures, packages, markets, and distributes generic versions of brand pharmaceutical products in the United States.

- Opko Health Inc OPK – a healthcare company that focuses on diagnostics and pharmaceutical business worldwide.

- Precigen Inc PGEN – develops gene and cellular therapies in the United States.

- Senseonics Holdings Inc SENS – a medical technology company that develops continuous glucose monitoring CGM systems for people with diabetes in Europe.

- Sirius XM Holdings Inc SIRI – provides satellite radio service on a subscription fee basis in the United States.

- TherapeuticsMD Inc TXMD – a women’s healthcare company in the United States.

- United Microelectronics Corporation UMC – a semiconductor wafer foundry that operates worldwide.

You can follow along with this experiment and my portfolio of short squeeze investments here. M1 Finance is currently offering $30 when you sign up and fund your account.

I’ll start with a 10% stake in each of these companies. You might recognize Sirius XM Satellite Radio but have no ideas about some of the other stocks. Remember, these picks are pure speculation on my part … this is not investment advice.

Rather, this is for educational and entertainment purposes. I am a finance blogger, YouTuber, and podcaster who makes content on what’s going on in the world of money. As the world continues to evolve and investing becomes more social, I plan to be there as a resource for you.

Listen to Teacher Entrepreneurs Podcast

As always, I’m Rich and until next time.

“teachingmillionaires.com has partnered with CardRatings for our coverage of credit card products. teachingmillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”