Should You Buy Amazon Stock?

Here’s an overview of how using fractional shares of stock can help you buy portions of large companies such as Amazon AMZN, Apple AAPL, Tesla TSLA, and Google GOOGL – and how fractional shares can help diversify your investment portfolio.

What Are Fractional Shares of Stock?

Fractional shares of stock allow you to buy a small portion of an individual stock. For example, if you want to purchase an expensive stock like Amazon, then normally you need to buy the entire stock. Currently, Amazon is trading for over $3,000 per share.

Unless you have tens of thousands of dollars to invest, then buying one expensive stock like Amazon gets in the way of creating a balanced, diversified portfolio.

Instead, let’s think of fractional shares like buying a slice of pie instead of the whole pie.

Only have $1,000 to invest? Then, you can buy exactly $1,000 of any stock. This is sometimes called dollar-based investing. It’s helpful for people who like to invest routinely with a set amount of money.

Do Fractional Shares Work the Same as Regular Stocks?

Yes, fractional shares work the same way as regular stocks. If the share price goes down, then you’re going to lose money. However, if there’s a percentage gain, then you’re going to gain that same percentage.

Likewise, if the stock pays dividends, then you’re going to be paid a fractional dividend. If you own ½ of a share and there’s a $1 dividend, then you’re going to get 50 cents.

Is Buying Fractional Shares of Stock Right for You?

The first thing that attracted me to buying fractional shares of stock was access to a wider pool of investment options. You are able to buy any publicly traded company. The amount of money you have to invest no longer restricts the type of stocks available to you for investment.

Picture this … you open a taxable brokerage account and plan to . Using fractional shares, you are still able to buy the exact same type of portfolio as someone investing thousands of dollars each week.

The next benefit of fractional shares is that you can diversify your portfolio much easier. For example, you can immediately buy multiple companies based on how much you want invest. Usually, buying full shares of stock takes months upon months of , but with fractional shares you can build diversification inside your portfolio right away.

It can be very expensive to diversify when buying full shares of higher priced stocks. One full share of Amazon right now would take up 10% of a $30,000 portfolio. That type of overweight allocation can be easily avoided by investing in fractional shares.

Isn’t Investing in Fractional Shares of Stock Risky?

Yes, investing is a risk. While you can potentially earn a larger amount of money buying and holding individual stocks, there are risks. You could lose money, and you must be prepared for the routine ups and downs of the market.

My suggestion is that if you’re already investing for your retirement, , and paid down high-interest debt, then buying fractional shares of stock might be right for you.

Should You Buy Amazon Stock?

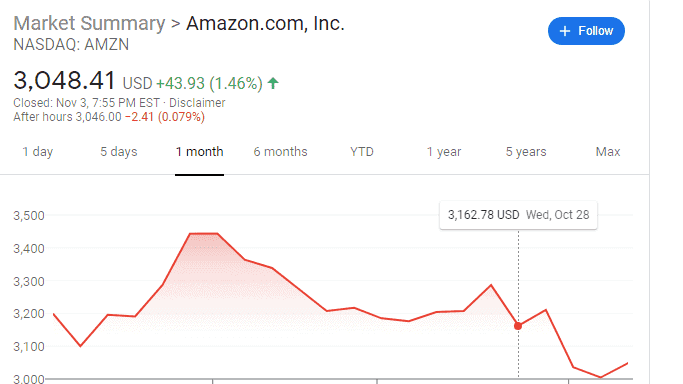

Let’s dive into the research. Amazon AMZN is currently down for the month. I’m posting this November 2020.

Year to date, it’s been growing nonstop.

It’s a company I know and trust is going to be around for the long-term. I’m happy to make an investment in Amazon AMZN.

What Other Stocks Should You Buy?

Apple AAPL

My next purchase is going to be Apple. As you can see, Apple is down for the month. Funny enough, I just bought a new iPhone this week. I’ve been using iPhones for the past eight years and own a MacBook Pro.

Year to date, it’s up. Apple is a company I’ve used for a long time. I’m happy to invest and hang on to it long-term.

Tesla TSLA

Many of you probably saw this next one coming. Everybody’s been talking about Tesla, but it’s down for the month.

Year to date, it’s up.

Telsa stock has just skyrocketed. No, I don’t own a Tesla, but I do like what the company is doing in the solar sector. I am attracted to this company and look forward to seeing it grow long-term.

Google GOOGL

My final stock is . Many people are working from home on their computers, and every kid in school is online learning using Google Classroom. is more popular than ever, and Google owns YouTube. I really like this company. They are up for the month.

Year to date, they are about even.

Where to Invest Using Fractional Shares of Stock?

I wanted to share with you how I was able to buy these larger companies using fractional shares of stock. When doing my research, I looked at everything from Vanguard to Robinhood. Even the allows to you buy fractional shares of stock.

I went with because there are absolutely no fees for buying or selling, and there are no management fees. You have to be mindful of fees when buying fractional shares of stock because fees can quickly eat up a lot of your money.

Wherever you decide to open an account, please do your own research. Investing is a risk. M1 Finance was by far the best place for me because I’m the type of person who likes to invest on a weekly, bi-weekly, and monthly basis.

My plan is to purchase $1,000 of these four stocks and have an equal 25% portion of each. After that initial investment, I’ll continue to invest at least $100 per month. I will be adding more stocks, so my pie will evolve over time and reallocate.

You can see what I buy next right here (link coming next month). Also, check out a Pie Preview of My Portfolio and its performance.

Keep in mind, I have blog posts, videos, and podcasts all about banking basics and the power of index funds. I use index funds to fully fund my Roth IRA, 403b, invest in a taxable dividend brokerage account, and fund my 457b.

Investing in fractional shares of individual stocks is research and content for me. It’s a bit of the end game when it comes to the order of filling your money buckets. I recommend paying down your debts, , and saving for retirement before buying fractional shares of individual stocks.

Listen to Teacher Entrepreneurs Podcast

As always, I’m Rich and until next time.

“teachingmillionaires.com has partnered with CardRatings for our coverage of credit card products. teachingmillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”

2 Comments