Should You Buy Cruise Stock?

Here’s an overview of the stocks I’m most excited about buying this month – Royal Caribbean RCL, Southwest Airlines LUV, Square SQ, Netflix NFLX, and CareTrust REIT CTRE.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

Should You Buy Cruise Stock?

Cruise stock is massively down for the year. Ships haven’t sailed in months, and there’s speculation that cruises won’t be allowed to resume until January 2022.

Royal Caribbean, ticker symbol RCL, has proved to be a resourceful company. They’re getting ready to launch a series of short ocean-only cruises. This is where the ship sails at 50% capacity, does not stop at any ports, and all passengers are tested for COVID-19 before boarding. Essentially, these cruises consist of going out to sea then coming back.

Is there excitement about this type of cruise? Yes, in fact, when Royal Caribbean asked for volunteers for test cruises over 100,000 people signed up.

There are always risks associated with . Stomaching volatile is difficult, especially if you aren’t investing long-term. With every good piece of news, cruise stock could go up. But as soon as warning levels rise, it could go down.

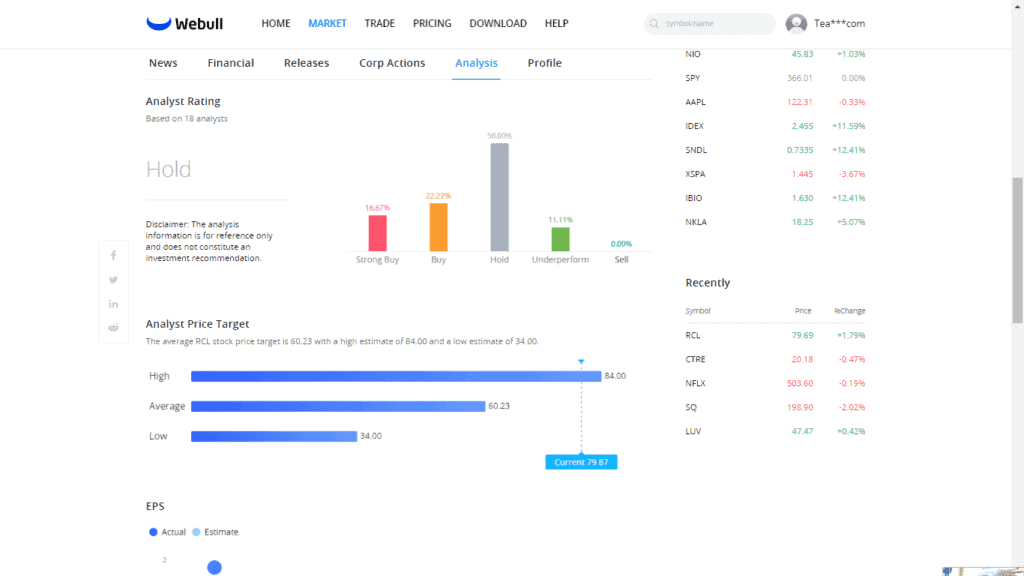

I anticipate when things open back up, people are going to want to travel and go on vacations. Royal Caribbean will be a winner in the long run. Let’s check to see what the analysts have to say. Most analysts have RCL as a “Hold” right now with a target price around $60. Currently, it’s trading closer to $80.

What Other Stocks Should You Buy?

Southwest Airlines LUV

Southwest Airlines, ticker symbol LUV, is a favorite in our household. We have been big fans of Southwest for years. Companion Pass, anyone? We love the flexibility of checking two free bags, and this is especially helpful when traveling with small children.

As a company, they are struggling right now. They might have to do their first round of layoffs ever in the company’s 53-year history. Looking at the performance of their stock, they are drastically down for the year.

Despite these obstacles, there are some bright spots for Southwest. They recently announced new flight options to smaller airports such as Colorado Spring and Sarasota, Florida. Also, the Senate recently proposed over $17 billion in federal aid for the airline industry.

I like the scrappy nature of Southwest to innovate and approach these difficulties as an opportunity to scoop up market share. Southwest is essentially going on the offensive, trying to grow their company during this shutdown.

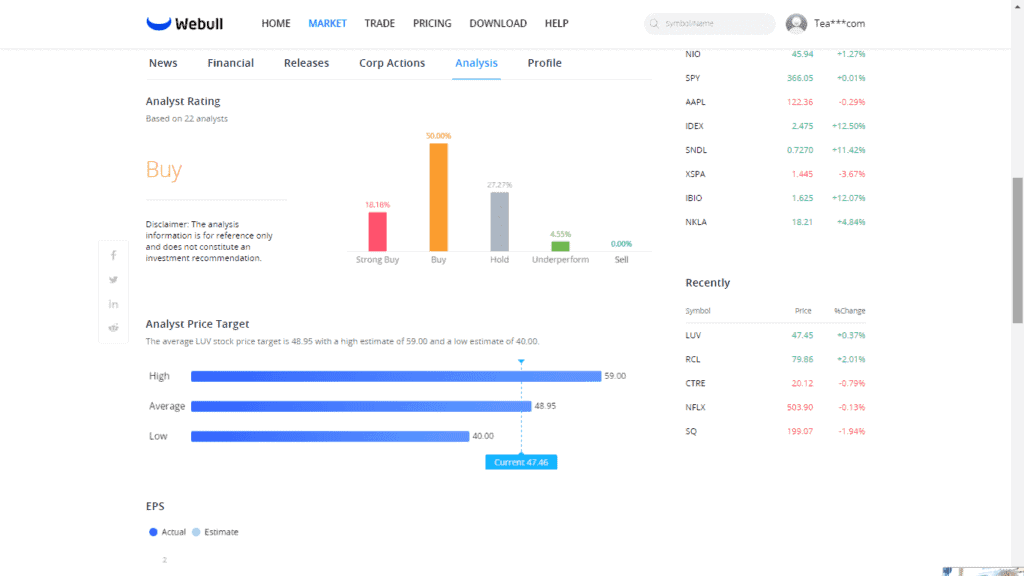

Keeping these reasons in mind, I am very interested in buying Southwest stock. Let’s see what the analysts say. LUV is a “Buy” right now with a target price around $50. Currently, it’s hovering around $47.

Square SQ

Square, ticker symbol SQ, is a business-to-business company known for helping sellers perform point of sale transactions. For example, if you’ve ever seen that little white swiping thing that plugs into phones then that’s Square hardware.

In addition to point of sale, Square offers a variety of other business solutions. For example, they help small businesses with bookkeeping and integrated payroll. During stimulus package rollouts, Square also assisted with PPP loans.

They recently announced the acquisition of Credit Karma’s tax prep business, so they’re officially in the tax filing game now. Come springtime, Square will help millions of people file their taxes electronically.

One more interesting piece of news is that Square has been , specifically Bitcoin, in massive quantities. In fact, it’s estimated that Square bought approximately 40% of all Bitcoin mined over the past two years.

My prediction is Square wants to own a substantial quantity of cryptocurrency to be a market leader when Bitcoin becomes more normalized for people to buy, sell, and trade.

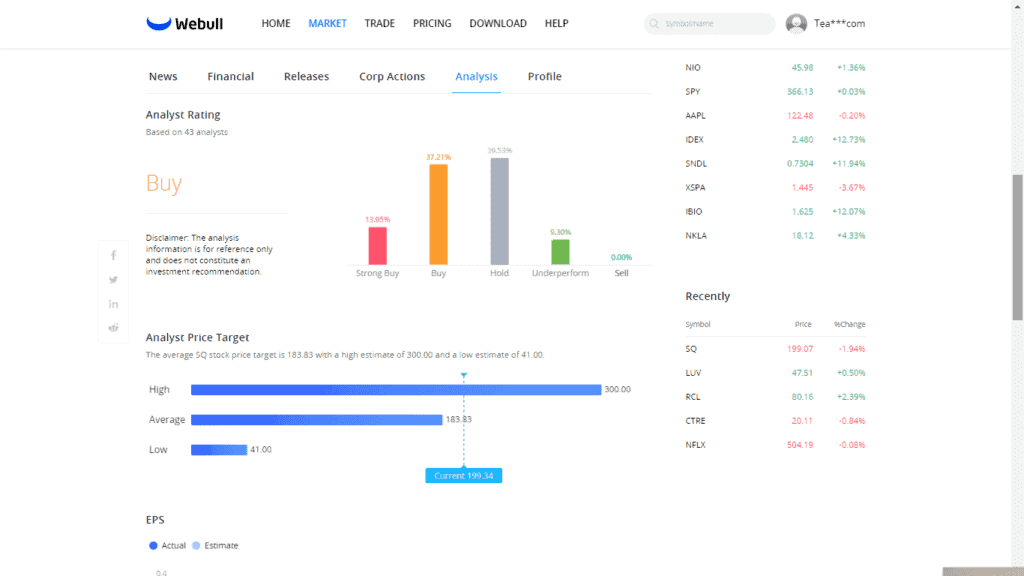

Let’s check to see what the analysts say about Square. It’s a “Buy” with a target price around $183. It’s currently trading just over $200.

Netflix NFLX

This next stock needs no introduction. Netflix has been on a tear the past few months. They are way up for the year and have plans to continue to grow.

The obvious way for Netflix to grow is to raise its subscription price. It hasn’t raised prices in the US since the start of 2019. With over 195 million subscribers worldwide, raising its prices $1-$2 a month per subscriber would increase their revenue over $2 billion.

They also continue build out their infrastructure with a $1 billion studio expansion planned in Albuquerque, New Mexico. Filming and producing their own content allows them to own the rights and the distribution channels.

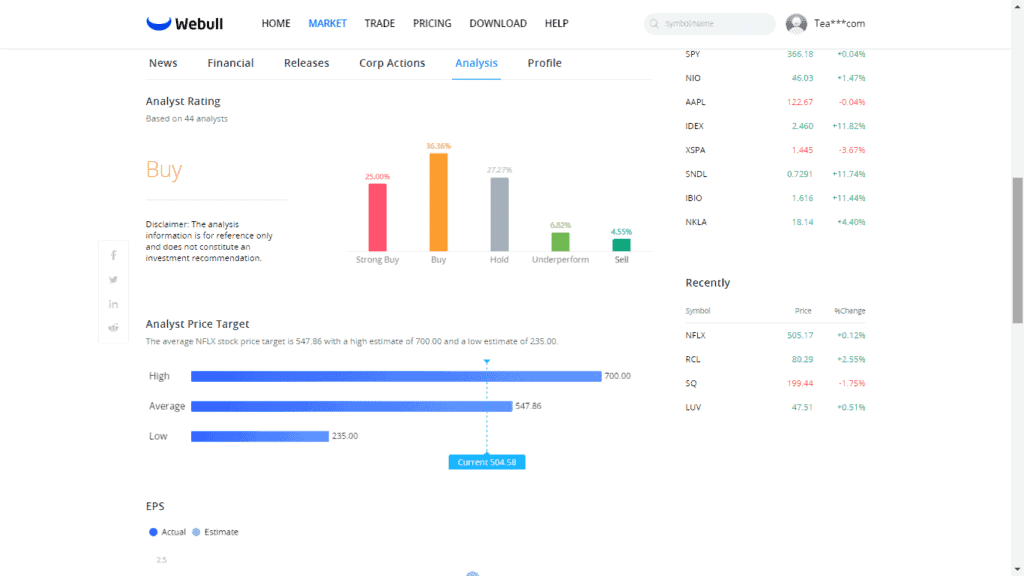

Netflix is a super interesting company that we all need to keep an eye on. Let’s look at what the analysts say. It’s a “Buy” with a target price of $548. Currently, it’s trading for $504.

Care Trust REIT CTRE

If you’re not familiar with the term REIT, it stands for real estate investment trust. Care Trust REIT is a company that primarily focuses on purchasing and acquiring facilities for healthcare operations. CTRE owns the land, the buildings, the facilities, and they lease these out to other companies that operate healthcare services.

Their stock is down for the year, but they’ve continued to grow. The reason this specific REIT caught my eye is they have continued to make acquisitions even when the economy has essentially shut down. For example, in September 2020 they acquired two skilled nursing facilities in Montana. Then last month they purchased four post-acute care facilities in Texas.

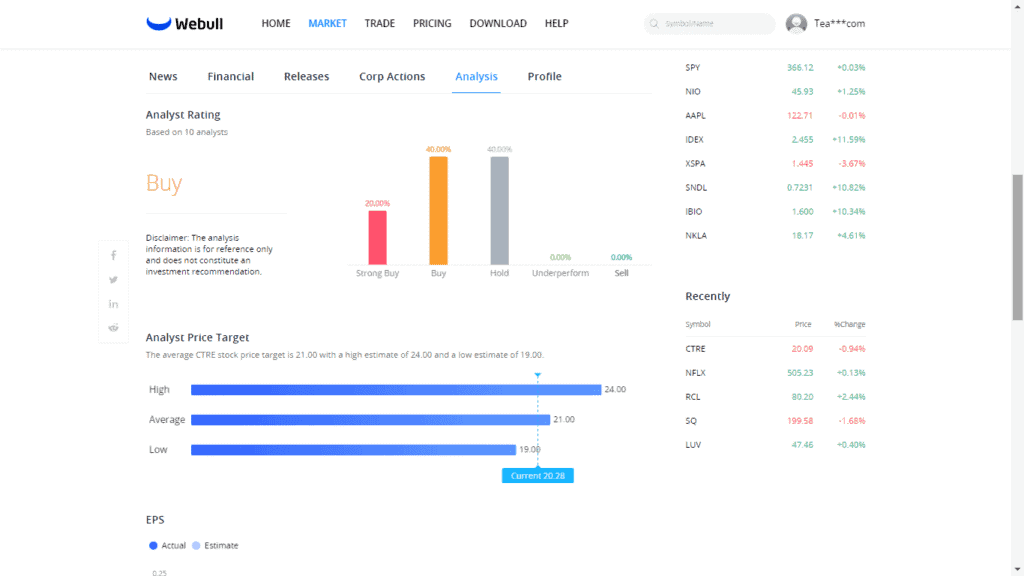

With the change of leadership in Washington, the new administration has a comprehensive plan for healthcare sector spending. This prospect makes Care Trust REIT very attractive. Let’s check with the analysts. CTRE is a “Buy” with a target price of $21. Currently, it is trading just below $20.

Recap: Four Stocks I’m Most Excited About This Month and Why

Okay, let’s recap. I am very interested in purchasing cruise stock and holding it long-term. The prospect of ocean-only cruises with the ship half full makes me want to take a vacation. I can’t predict the future, but once things start to open back up people are going to want to travel. Royal Caribbean is a leader in the cruise industry and will continue to adapt.

I also like Southwest Airlines for some of the same reasons. They’re going to have to deal with union contract negotiations very soon. During those months, I will routinely buy LUV. Hopefully, when things open back up, Southwest will have a larger share of the airline market.

Square is another innovative company that impresses me. I like the risks they’re taking with acquisitions and cryptocurrency. It will be very interesting to see how they continue to grow.

Netflix is a company I’ve wanted to own for a long time. I’m happy to add it to my portfolio. As they continue to expand, I look forward to seeing what they’ll do next.

Care Trust REIT is on my long-term radar. With future government plans to focus on healthcare spending, I’m glad to add them before the changeover in Washington.

You can read about what stocks I picked last month here. Also, check out a Pie Preview of My Portfolio and its performance.

If you’re new to investing or just like free stocks, . I got Levi Strauss & Co. LEVI and PagerDuty PD. If you sign up, let me know what stocks you get in the comments.

when you sign up & link a bank account.

Coinbase is offering $5 worth of free Bitcoin when you open an account.

I also really like M1 Finance for buying fractional shares of stock. when you open and fund your account.

As always, I’m Rich and until next time.

Listen to Teacher Millionaires Podcast

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”

2 Comments