What’s the Minimum Amount You Can Invest in Bitcoin?

Investing in Bitcoin has become increasingly popular for both skilled investors, as well as novices looking to get in on the Bitcoin rage. Many say Bitcoin is the future, but that doesn’t mean you should take thousands of dollars and invest your hard earned money without educating yourself more about cryptocurrency.

The minimum amount you can invest in Bitcoin depends on the platform, with some allowing an investment as small as one cent and others ranging from $1.99 to $5.00 minimums. However, each platform also has additional charges and fees for buying and trading, which can eat into the value of your investments.

If you’re interested in investing a small amount of money into Bitcoin, read on to figure out which platforms offer the smallest investment options while also charging minimum fees for your purchases and sales. That way, you can capitalize on investing a small amount of money while also getting the best return on your investments.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

What’s the Minimum Amount You Can Invest in Bitcoin?

What is the Lowest Amount You Can Invest in Bitcoin?

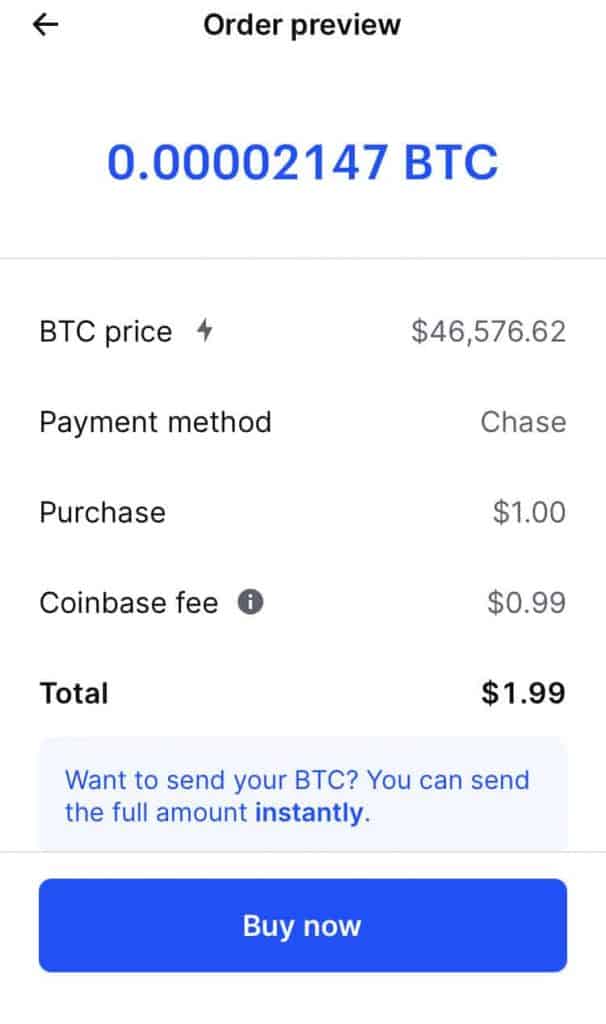

The lowest amount you can invest in Bitcoin depends on the platform you are using for your investments. For example, the site LocalBitcoins allows investors to make a minimum investment of one cent, while other sites like Coinbase have a minimum Bitcoin investment of $1.99. There is no worldwide, consistent minimum investment for Bitcoin.

Because the minimum amount you can invest in Bitcoin is set by the platform you are using, you need to compare the different platforms to see which one has a minimum investment option that makes you most comfortable. You should also research fees the exchange platform charges for buying, selling, and transferring Bitcoin.

If your investment is too small, you may end up paying more on fees than you are getting on your investment. I recommend that beginner investors buy a minimum of $50 in Bitcoin in order to see any profit from their investment after fees. Bitcoin investment minimums are based on your local, designated currency:

- LocalBitcoins – 1 cent minimum

- Coinbase – $1.99 minimum

- Gemini – 0.00001 Bitcoin

LocalBitcoins has a unique “peer-to-peer” platform that allows you to send payments to a person’s bank account in exchange for Bitcoin. For example, you could send someone one cent of Bitcoin directly to their bank account. Registering for a LocalBitcoins account is free, but there’s a 1% fee per completed transaction.

I would be careful using LocalBitcoins within the United States because the company is based in Finland, and recent changes to their Terms of Service restrict accounts in most U.S. states.

Coinbase is widely accepted as one of the most secure and recognized crypto exchanges. $1.99 is the minimum purchase price for Bitcoin on Coinbase, and there is a $0.99 USD transaction fee. This means that nearly half of your investment goes to fees when purchasing such a small amount of Bitcoin using Coinbase.

Gemini is another trusted crypto exchange with a “market minimum” of 0.00001 Bitcoin per purchase. This means the minimum amount you can invest in Bitcoin is based on the current price of Bitcoin. This means it’s possible to buy as little as $1 of Bitcoin on Gemini, but keep in mind there is also a $0.99 USD transaction fee.

What are Spreads in Crypto?

Spreads in crypto are an adjustment on the purchase price or sale price of your investment. Typically, the spreads are slightly higher than market price, so this can lead to paying more on top of other fees. Add up all the fees and the spread, and the value of your smaller Bitcoin investment can vanish.

Coinbase is a very popular platform with more than over 55 million verified users from more than 100 countries. They have flat fees ranging from $0.99 to $2.99, but they also have a variable percentage fee between 0.5% to 4.5% based on larger amounts of Bitcoin transferred. Additionally, they charge a 0.5% “spread” for sales and purchases to help factor in market fluctuations.

Reasonable when compared to other platforms, you need to be aware of Coinbase’s spread and fees. Also, if you use a debit card you will be hit with a debit card fee that could reach 3.99% of your transaction. Therefore, if you only invest their minimum of $1.99, these fees could eat up any value you make from smaller Bitcoin investments.

- Gemini – Transaction fees range from $0.99 to 3.99% of your order, depending on the amount of your purchase or sale. There’s also a 3.49% fee for debit card purchases.

- Binance.US – Charges a flat 1% fee on all trades in addition to a withdrawal fee.

- Kraken – Has lower fees ranging from 0.9% to 2% but other fees may also apply.

I could go on to name other platforms that are easy to use and ideal for beginners, but not all are available to U.S. citizens. For example, my home state of New York is highly restrictive when it comes to cryptocurrency exchanges, so make sure to do your own research before signing up. In my opinion, it’s not worth trying to circumvent federal KYC (Know Your Customer) laws just to sign up for one exchange over another.

Related video content: Will Dogecoin Hit $1?

What is the Difference Between a Crypto Wallet and Crypto Exchange?

It’s important to understand the difference between a crypto wallet and crypto exchange:

- Crypto wallet: Safely stores your cryptocurrency and private keys

- Crypto exchange: Where you can buy and sell your cryptocurrency

You’ll want to research the prices and commissions each platform charges, the number of coins and tokens available, the ease of their customer service, and which Bitcoin exchange is safest. Like any form of investing, Bitcoin is a high-risk investment that does not guarantee a high return on investment.

The best way to protect your money is to diversify your overall portfolio beyond just Bitcoin. Primary investments such as long-term savings, retirement, and lifestyle assets are all usually lower risk. After you take care of the basics, then you can invest a portion of your net worth in more high-risk investments like cryptocurrency.

There are sites like Personal Capital that work with Bitcoin platforms to help you track your assets. Personal Capital works with Coinbase to help you keep track of crypto trades, and these budgeting tools can also help you keep track of your daily spending and other investments.

How Do Beginners Buy Bitcoin?

The first steps when beginners are ready to buy Bitcoin is to decide the minimum amount you want to invest, which platform you will use, and the fees associated with your investments. Most exchanges will provide you with a crypto wallet where your coins are stored by the provider. I’d also recommend investing in a cold storage hard wallet in order to be able to transfer your investments off the exchange when you’re ready for that step.

Once you register with the exchange of your choice, you’ll want to link your bank account, so you can easily buy and sell Bitcoin. Using a bank account can also help you avoid additional fees some platforms charge for using a debit card or credit card.

Now that you are ready to purchase Bitcoin and manage your investments, you’ll notice the price of Bitcoin might be tens or even hundreds of thousands of dollars, which is way above your minimum investment as a beginner. But you can purchase a fraction of a single Bitcoin called a satoshi–a satoshi is the smallest unit of one Bitcoin and equivalent to 100 millionth of a single Bitcoin.

Below are the main steps you will take when you’re ready to enter the Bitcoin market:

- Choose a cryptocurrency exchange platform

- Register for an account and get your crypto wallet

- Link your bank account to the cryptocurrency exchange

- Place your Bitcoin order and manage your investments

Once you purchase your first Bitcoin, you can use them in any online transactions that accept them or leave them in your account as an investment with the hopes that their value grows. Remember that the value of your Bitcoin will fluctuate depending on the value of the market. The value will also increase as more people find, learn, and invest in Bitcoin.

Key Takeaways

Investing in Bitcoin is very similar to investing in the stock market because both can be risky, confusing, and intimidating. However, everyone has to start somewhere. Once you figure out your minimum investment, weigh that amount with the fees charged by the different cryptocurrency exchange platforms, then you can decide where to invest your money for the best return on investment.

As always, I’m Rich and until next time.

Listen to Teaching Millionaires Podcast

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”