BEST RETIREMENT PLAN | How to Fill Out 457 Application

Here’s an overview of how to fill out a 457 retirement plan application for New York State.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

What’s a 457 Retirement Plan?

Before I walk you through the process of signing up for a 457 retirement account, you may want to check out my post all about the basics of the 457. It explains an overview of why it’s the best retirement plan.

Why You Probably Don’t Have a 457 Retirement Plan Yet

One of the things impeding people from already having a 457 is knowing how to open the account. Do you have to fill out a paper form and send it in the mail? Do you have to call someone? Is there a shady advisor trying to add fees and take advantage of you?

Well, let me walk you through the process of opening up a 457 retirement account. It’s something you can do online by yourself. I am in New York state, so I’ll be using New York state’s online portal.

Just to be clear, this type of retirement plan must be offered by your employer. Most state and local government agencies offer 457 plans. Check with your own state and employer to make sure it’s available and a quality plan.

How to Fill Out a 457 Retirement Plan Application

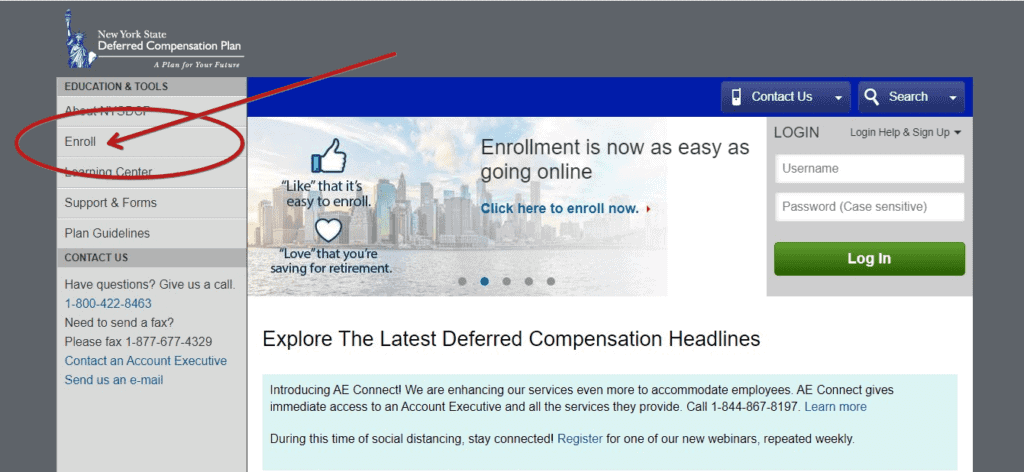

This is what the New York state homepage looks like to sign up for their 457 plan.

Go ahead and click enroll. By the way, there is paper option available, but it can get a little confusing because you need all the proper ID numbers. Also, they offer a phone number you can call.

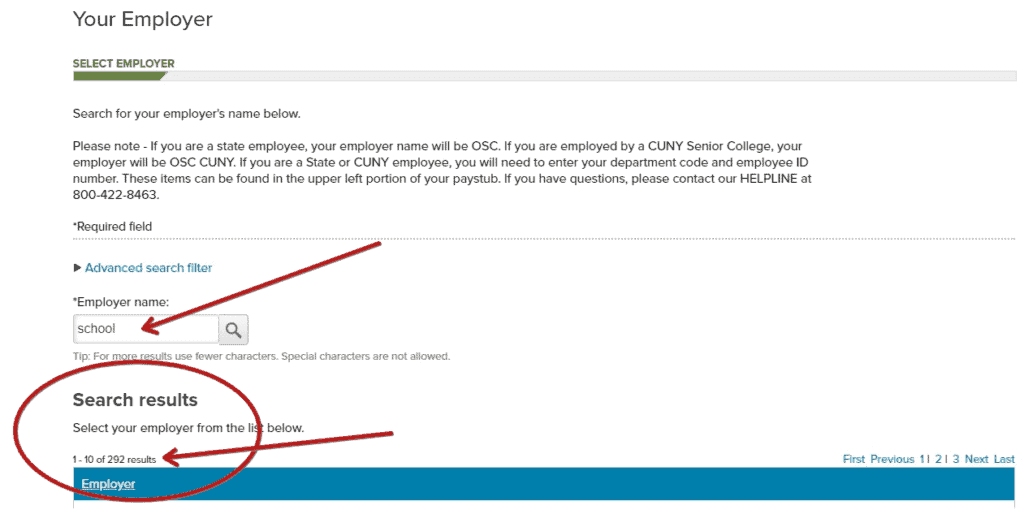

Start by finding your employer. You’re going to notice when I typed in the word “school” over 300 different employers in New York state populated. Select your employer from the drop-down menu.

If you are a state employee, sometimes they refer to you as an OSC. Likewise, if you work for a college, there might be another distinction. Be careful you’re selecting the correct employer.

Basic Information

They need to know your first and last name, date of birth, and social security number. Next, they ask for your marital status. I think this has to do with taxes.

Home address including street, city, state, and zip code comes next. When they ask for your primary phone number, it’s okay to put a cell phone or home phone. For email address, don’t put your school or work email. Remember, this is going to be an account you continue to access after you leave service. Go ahead and put your personal email address.

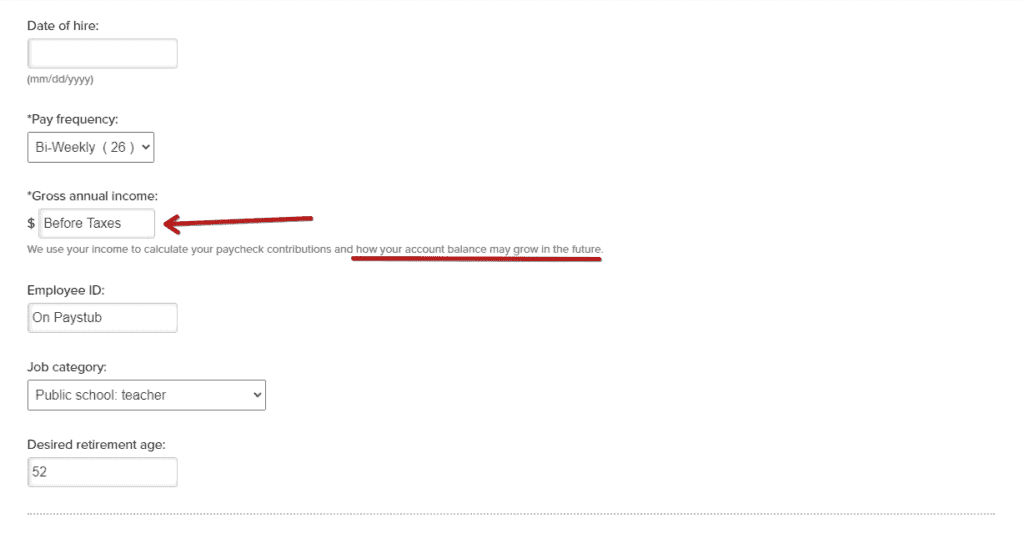

Do you remember your date of hire? You might not if it was years ago. They’re asking for the date when the board of education or your boss signed off on officially hiring you. Make sure you have your original hire date and ask human resources if you can’t find it.

Pay frequency – I couldn’t select anything besides 26 pays. Some teachers get a balloon payment in June or get paid twice monthly, so select whatever is appropriate.

Where it asks for gross annual income, put all the money you earn from your job before taxes and everything else is taken out. You can reference your contract pay schedule and be sure to include things like coaching and other stipends. The reason they ask for this figure is because they offer interactive tools to help you plan for retirement and make projections for the future.

When they ask for the employee ID, this should be on your pay stub. For me, it’s in the top left-hand corner. However, if you’re unsure contact human resources.

Next, they have a drop-down menu for job category. Select what’s appropriate and fits your position.

Retirement Planning Information

You’ll also see that they ask for your desired retirement age. This has nothing to do with your pension or age 59 ½. Rather, they want to know when you want to retire. Put whatever number you want, and those interactive tools I mentioned earlier will help you visualize if you’re going to have enough money or if there’s going to be a projected shortfall.

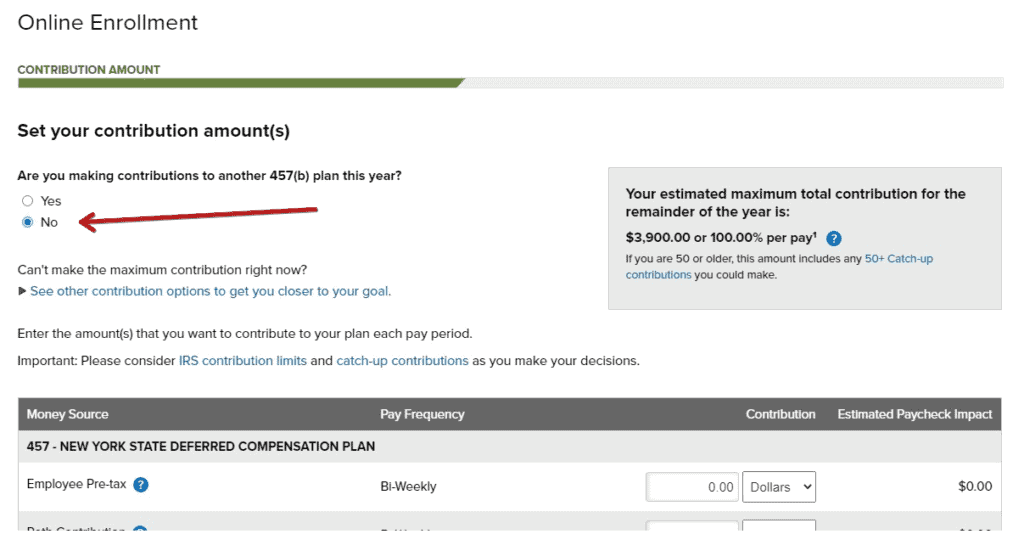

When they ask about contribution amounts, they’re factoring in your gross annual income. Next, they ask a couple of questions about whether you’re already making contributions to another 457 plan. There are some automatic calculations estimating how many more pays you have left in the current calendar year and what percentage you can contribute from your paycheck to maximize this year’s contribution.

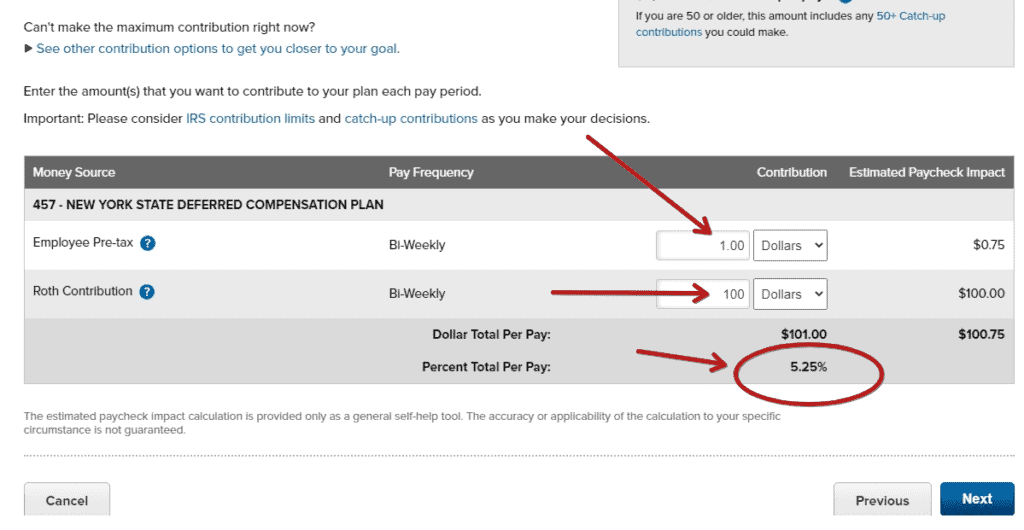

If you scroll down a little bit, they’re going to want to know the money source. This means how you’re going to fund the 457 account. Your choices are pre-tax, post-tax meaning Roth, or a little bit of both.

Pre-tax means the funds are taken out of your paycheck before tax and federal income tax is deferred until you withdrawal the money in the future. Post-tax also known as Roth means you pay tax now but then all the contributions and earnings can be withdrawn tax free when you separate service.

You can choose either option or a little of both. I do something called the “Trickle Method®.” This means I contribute $1 pre-tax every paycheck, and the rest is a Roth contribution. “Trickling®” that $1 allows me to easily bump up pre-tax contributions by changing one number.

I don’t want to get too in the weeds by talking about tax planning right now, but the 457 is awesome for helping you decide how much tax you want to pay each year. Consider your own situation then pick whatever you think is best for you.

There are maximum contribution limits and special catch-up rules. I go into more detail in my other 457 post.

I really like that they show you an estimated paycheck impact. You can see how pre-tax money allows you to invest $1 and only miss 75 cents from your paycheck. With the Roth contribution, investing $1 deducts $1 from your paycheck.

Investment Options

Up next, they ask how you want to invest your money. This part can be really overwhelming. It’s okay to feel that way. I have posts about index fund investing that will help you better understand how to make these decisions.

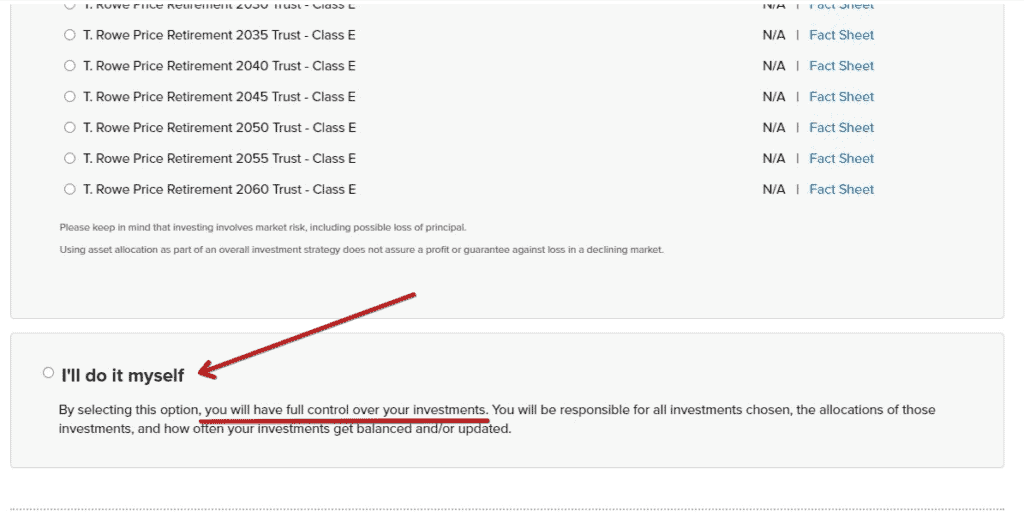

This plan offers options where they can choose investments for you, but this includes higher fees. Be prepared to answer questions about risk tolerance, then they mostly likely put you in a target date fund that adjusts as you get older. If that’s something you are comfortable with, I suggest asking questions and doing your own research before deciding.

They also offer another option called “I’ll do it myself.” This means you have full control over your investments. Doing it yourself keeps fees drastically low and means you can invest more money because you aren’t paying someone else to help you invest. This is the option I selected.

Whatever you choose, you must invest a percentage that is equal to 100%. They also give you the ability to pick different investments for your pre-tax and Roth contributions. Even though it gives me this option, I am to use the same investments for both types of contribution.

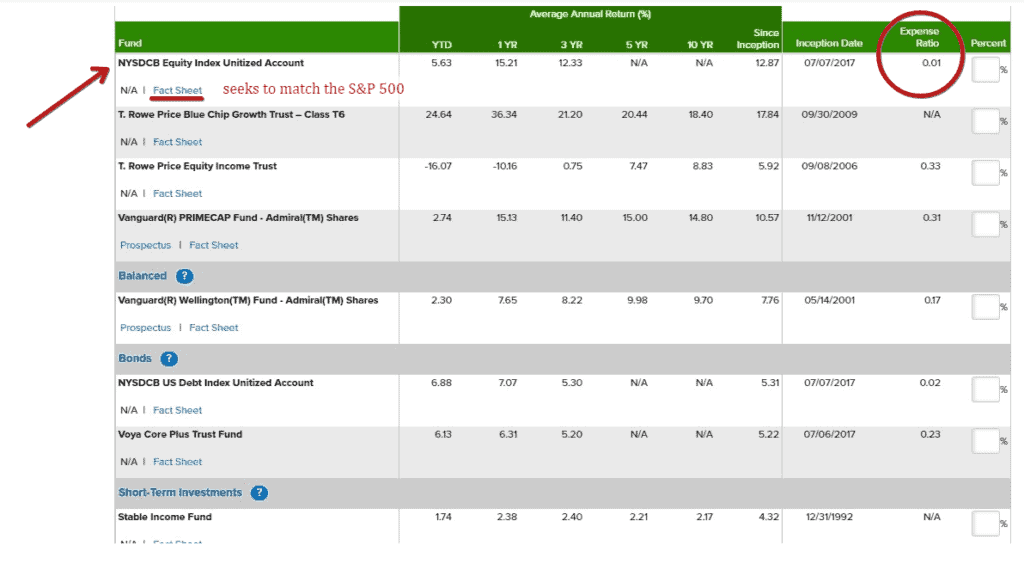

I’m not going to give specific investment advice, but I’ll share what type of funds I always look for when selecting retirement investments. Surprise, surprise … I look for low cost index funds that track another type of index. For example, a fund that tracks the entire US stock market or a fund that tracks the S&P 500.

The example shown here tracks the S&P 500 and has a very low expense ratio of 0.01. This means for every $1,000 invested there is a small 10 cent fee.

I also look for a fund that tracks a total bond market. Again, the example here seeks to track the entire US Bond market. It has a very low expense ratio of 0.02.

Please do your own research. Just because one fund might be up or down for the year doesn’t mean it’s going to perform the same way in the future. Overall, you want to develop a firm understanding of what makes you feel comfortable investing long-term.

Beneficiary Information

They ask you about beneficiary information, and you must put down at least one primary beneficiary. Sometimes they ask for that person’s social security number and date of birth. If you have a spouse or children and want to put a primary beneficiary and secondary contingent beneficiaries, then that’s an option.

It’s a good idea to keep beneficiary information updated on an annual basis.

Lastly, they require you to create a username and password for online access. Paperless delivery of statements and tax forms is available so you can get those sent to your email.

It’s fun to play around with their interactive retirement planning tools. They’re free to use and help you plan for overages, shortfalls, and factoring in things like an early retirement.

Talking about 457 retirement plans and getting people signed up is awesome for me. Teachers, public sector employees, and anyone who has the option should strongly consider opening an account.

457 accounts invite the possibility of early retirement because you can access the funds whenever you separate service or leave your job.

If you still have questions about 457 retirement plans, Dan and Scott over at 403bwise.org have a ton of great resources.

Keep the conversation going over in our private Facebook group.

Listen to Teacher Millionaires Podcast

As always, I’m Rich and until next time.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”