Employee Retention Credit and PPP

The Employee Retention Credit and PPP can work together to benefit your business. Despite what you may have heard, legislation changed multiple times surrounding ERC and PPP, and now your business can get money from both programs. If you are confused about the difference between the Employee Retention Credit and PPP, I’m here to help answer all of your questions.

The Paycheck Protection Program PPP is a program many people learned about late 2020 and early 2021. Many of those PPP loans have since been forgiven. Now I’m getting many questions about ERC, which is a tax credit available to business owners with W2 employees.

Yes, you are allowed to get both rounds of PPP funding and the Employee Retention Credit, so let’s examine how the two programs can work together.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

Employee Retention Credit FAQ

There have been many Employee Retention Credit FAQ since the program debuted in March 2020. Bottomline, if you kept W2 employees on the books during the pandemic, then you can apply with the IRS for a 2020 tax credit and a 2021 tax credit. Even if this is something you’re filing for retroactively, you can potentially get a check for up to $26,000 per employee.

However, there are ERC Qualifying Questions you must answer before calculating your potential tax credit. Also, there are some restrictions about “double-dipping” of funds when factoring in PPP and ERC. I’ve partnered with the ERC Specialists to help guide you through this process.

Let’s start with a quick reminder about how the Paycheck Protection Program worked. PPP was originally designed to be a forgivable loan. You could apply through a bank or a SBA-approved lender. They required a few payroll documents and/or tax forms, then the PPP money was deposited into your bank account.

There was an unbelievable amount of apprehension and confusion surrounding what constituted appropriate use of PPP funds. For example, PPP funds originally could only be used for approved expenses and partly for payroll. Then, there were multiple PPP rule changes by the SBA that eventually allowed the entire amount of PPP funds to be used for payroll.

It is important to note there’s a 60/40 rule applied to those wanting to use PPP funds for approved expenses. This means you must use at least 60% of PPP for payroll and at most 40% can be used for approved business expenses.

Many business owners spent all PPP funds on payroll. Whether that meant keeping employees on the books, or if you were a Schedule C worker, independent contractor, or sole proprietor then paying yourself 100% of the PPP funds. Again, the SBA eventually allowed more flexibility with PPP loans, letting you to spend the funds over a time period from 8-24 weeks.

Next came a second round of PPP funding and more rule changes, including a change in the calculation formula that allowed business owners to use Gross Income rather than Net Income. Overall, PPP had many twists, turns, and changes. So if you were among those who received those funds for your business and you’ve gotten them forgiven … well done.

Related Video Content: How to Apply for the Employee Retention Credit

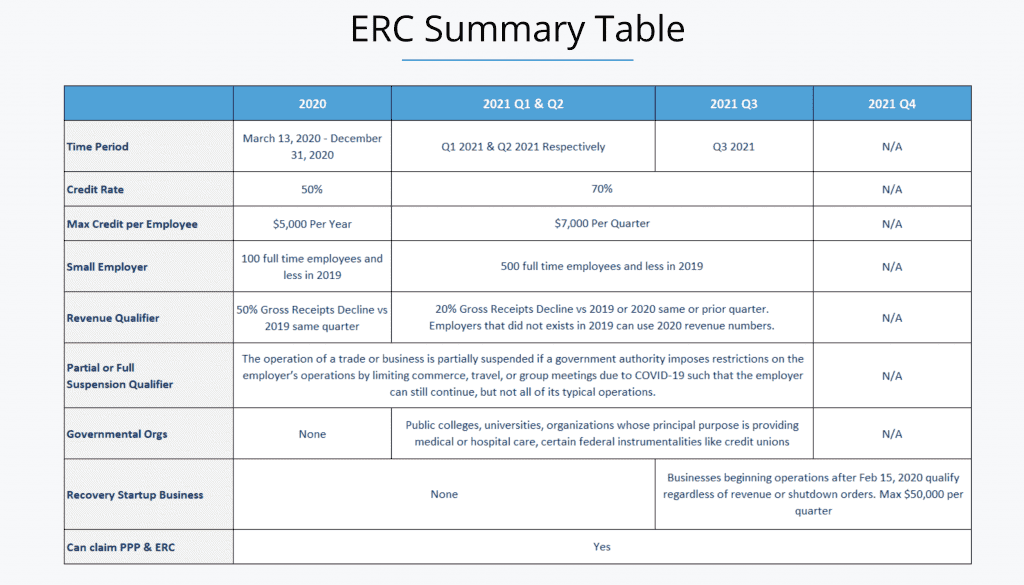

Employee Retention Credit 2020 and 2021

The Employee Retention Tax Credit ERC has different calculations for 2020 and 2021. However, before we dive into more about ERC, it is very important to understand that this tax credit is specifically designed for businesses with W2 employees. To clarify, sole proprietors, partnerships, and other businesses without W2 employees on the books do NOT qualify for the ERC.

How Do You Calculate Employees for Employee Retention Credit?

To qualify for ERC, you have to be the owner of a company that runs payroll and has non-family W2 employees. This applies to a large portion of businesses. I wrote a more in depth blog post as well as an overview video on ERC that you can check out here.

Originally, you were not allowed to apply for the ERC tax credit and get PPP money. My observations were that many people didn’t want to deal with the IRS, so they applied only for PPP. Then the ERC rules changed, and you could apply for and get ERC even if you received PPP funds.

Yes, you can get the Employee Retention Credit 2020 and 2021, even if you got PPP loans. Specifically, the many rule changes allowed for much more flexibility for 2021 ERC funds.

Let’s break this down with a helpful ERC example from a summer camp business owner in upstate New York:

- Tony runs a summer camp and makes use of many independent contractors

- However, he always keeps one W2 employee year round to help run things and keep the books

- ERC for 2020 allows that one W2 employee to qualify Tony’s business for up to $5,000 of ERC money

- ERC for 2021 is a bit more generous. They allow his business to get up to $7,000 per employee per quarter

- We’re talking Q1, Q2, and Q3 of 2021

- Recent legislative changes no longer allow ERC for Q4 of 2021 – this may change again in the future

- Using this summer camp example, Tony’s one W2 employee during 2020 and 2021 could make him eligible for up to $26,000 in tax credits

- $5,000 for 2020 and $21,000 for 2021 = $26,000 refundable tax credit back to his business for one W2 employee

- If he happened to have two or three W2 employees, then he could be eligible or even more funds

Overall, if you have W2 employees and your business was affected by COVID-19 shutdowns, then the Employee Retention Credit can be a valuable source of funding. If you are interested in seeing if you qualify:

- Answer the qualifying questions here

- Check out the ERC Summary Table below ?

- Read my blog post to learn more – Better than PPP | Employee Retention Credit

Can I Qualify for ERC If I Use PPP?

Many of you are probably asking yourself, “Can I qualify for ERC if I use PPP?” and the answer is yes and no. The key to understanding the interplay between ERC and PPP is there’s no “double-dipping” of funds for the exact same purpose during the exact same timeframe. For example, during quarters where you used PPP to pay your employees, then 90% of the time you cannot get ERC during that same timeframe.

However, if you used part of your PPP on wages and the rest towards approved expenses, then you might be eligible for ERC for wages paid out that weren’t from PPP money.

Hopefully, I didn’t lose you there. The sad truth is if you knew all of this information upfront, then you could have strategically used your PPP for expenses and wages while also maximizing ERC. Unfortunately, it’s too late for most of us to strategize PPP usage but that doesn’t mean you’re excluded from the ERC altogether.

That’s where my partners at the ERC Specialists come into play. They know all the qualifying information and paperwork to file to maximize the Employee Retention Credit for your business. Another benefit of using the ERC Specialists is that there is no upfront cost for you…they only take a flat-fee if you receive ERC funds.

How Long Does it Take to Get Employee Retention Credit Refund?

The IRS is backed up 12-24 weeks right now. Therefore, it might take anywhere from four to six months before you see ERC money. That is why it’s important to file now so that in several months you will have that helpful funding coming in for your business.

You Might Also Like: How to Pay Yourself PPP Loan Self-Employed

Key Takeaways

ERC and PPP weren’t originally designed to play together. In fact, they were like oil and water and just didn’t mix. As the rules began to change for PPP and the rules changed for ERC, it turns out your business can potentially benefit from both programs.

If you haven’t applied for ERC, then you are pretty much leaving money on the table.

Just remember that the ERC is specifically for business owners who have payroll with W2 employees. If at any time during 2020 and 2021, you were impacted by government shutdowns and/or if you had a reduction in gross revenue, then you’re probably going to get some money coming your way.

As always, I’m Rich and until next time.

Listen to Teaching Millionaires Podcast

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”