How to Apply for Employee Retention Credit

We have learned, (referenced here) there is currently a bill in Congress that, if passed, would result in the barring of any additional ERC claims from being submitted after 1/31/24. Due to the significant impact of the potential passing of this bill, new applications are no longer accepted, and any incomplete applications are no longer available to complete.

The Employee Retention Credit ERC is a federal program that is still available for business owners with W2 employees on the books during 2020 and 2021.

Today, I’m going to share with you one of the ways you can see how much ERC you qualify for and tell you how to apply for the Employee Retention Credit online to get those funds back from the IRS.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

What is the Employee Retention Credit?

The Employee Retention Credit is a payroll tax credit available to business owners who had W2 employees on the books during 2020 and 2021. You could be eligible for up to $26,000 per employee in tax credits that comes directly back to your business.

Is it too late to apply for the Employee Retention Credit?

While most business owners have heard about the Employee Retention Credit, many don’t realize that you can still retroactively file for three quarters in 2020 and three quarters in 2021.

Unless there are additional changes from Congress or the IRS, the deadline to file for ERC funds for 2020 is the middle of April 2024, and the deadline to file for 2021 is the middle of April 2025.

How do I apply for the Employee Retention Credit?

I wrote a deep-dive blog post that explains the basics of the Employment Retention Credit here. But the number one question I get is how do I to apply for the Employee Retention Credit.

This post and the images below walk you step-by-step through the process to see exactly how much ERC you potentially qualify for. Also, my processing partners at the ERC Specialists can help take care of all the necessary IRS paperwork, so you get your money back in your pocket.

How to fill out the ERC Qualifying Questionnaire Step-By-Step

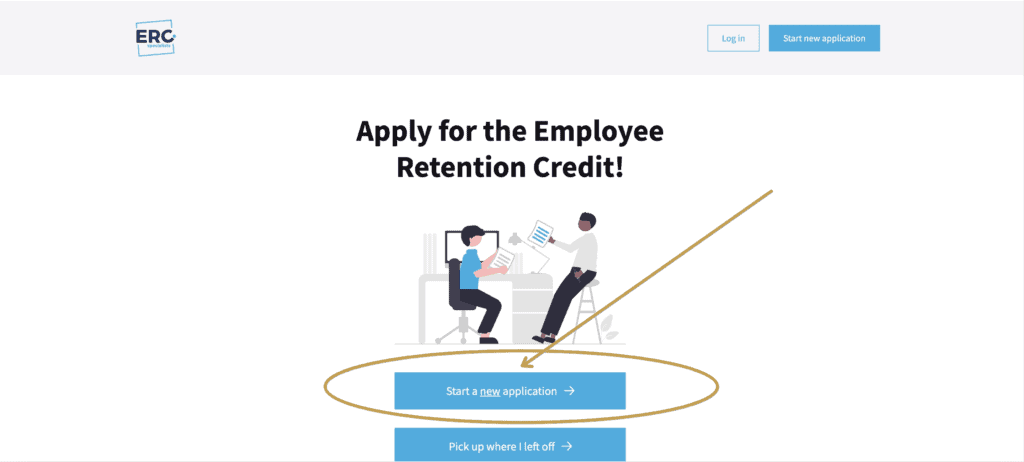

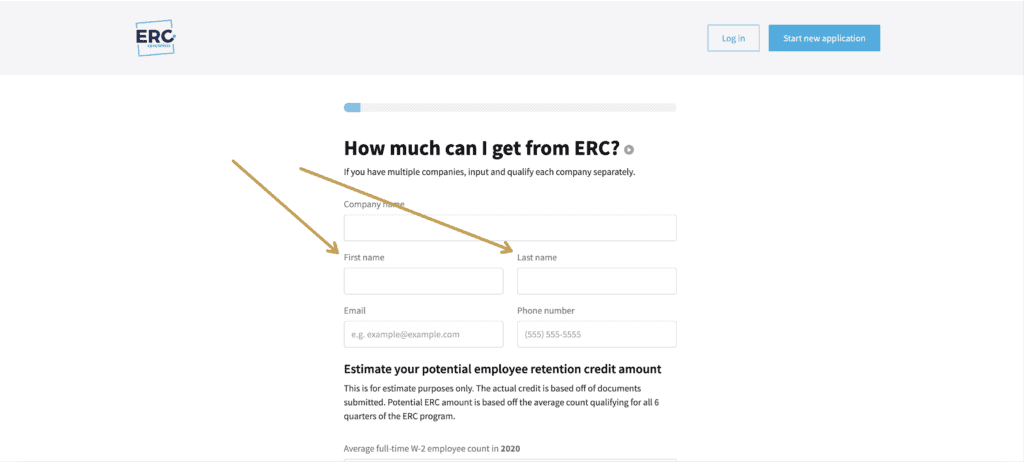

Above is what the landing page of the ERC Qualifying Questionnaire looks like. Begin by clicking on “Start new application”. If at some point you need to stop and come back later, then you can save your work within this online portal.

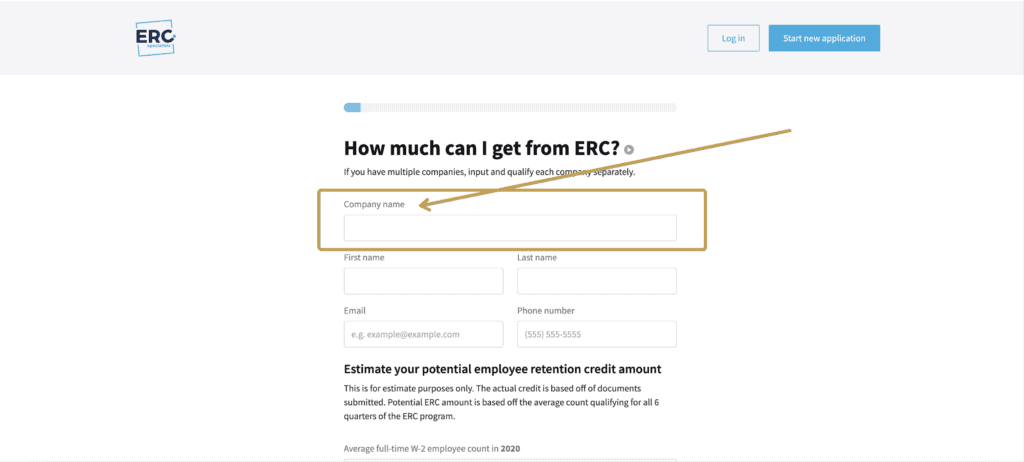

Next, you need to type in your company’s name. This is the name found on all of your official business documents such as articles of organization, business checking account, etc.

Type in your first and last name, business email address, and business phone number. This is where all the correspondence will go for the ERC processing. If you want to put your personal email or your personal cell, that works too. What’s really cool about this ERC qualifying questionnaire is that it will give you an estimate of your ERC amount and show you your progress on screen.

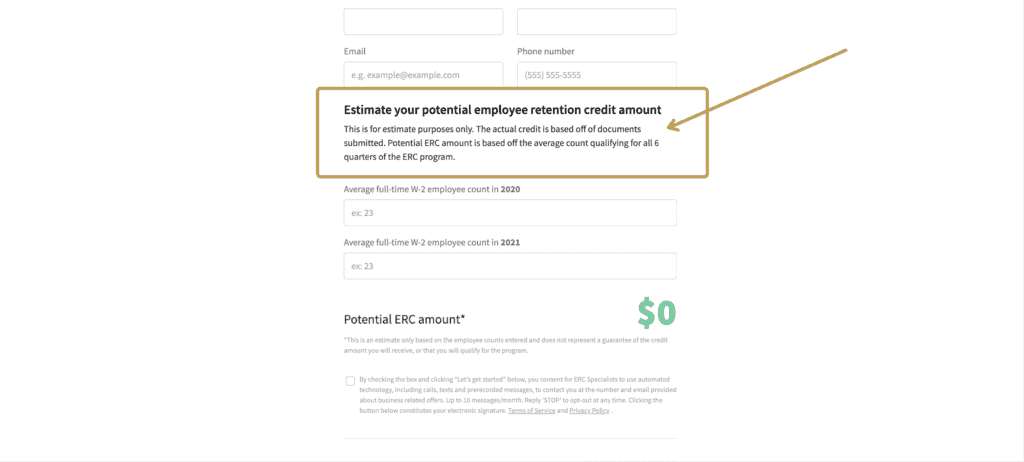

For this next section, they ask for the average number of full-time W2 employees you had on payroll for 2020 and the average number of full-time W2 employees for 2021. It’s worth noting that full-time (according to the IRS) is an average of 30 hours a week or 130 hours in a month.

There’s also great news for all you business owners that employ part-time workers or seasonal workers. Yes, you can include part-time/seasonal workers in your ERC calculations.

However, for this portion of the ERC qualifying questionnaire, only include the average number of full-time W2 employees. Next, check the box that says you’re opting in and agreed to receive all of the information electronically once you complete the questionnaire.

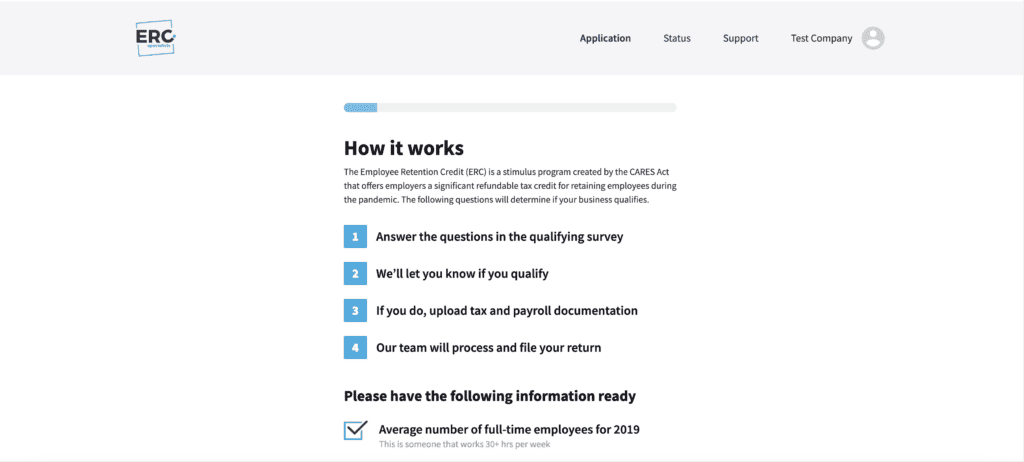

After you click “Let’s get started”, the next steps are to answer the questions in the qualifying questionnaire, upload specific payroll documents required to complete the ERC calculations, and then sign all of the Approval documentation to get everything filed with the IRS.

What types of documentation do I need to apply for the ERC?

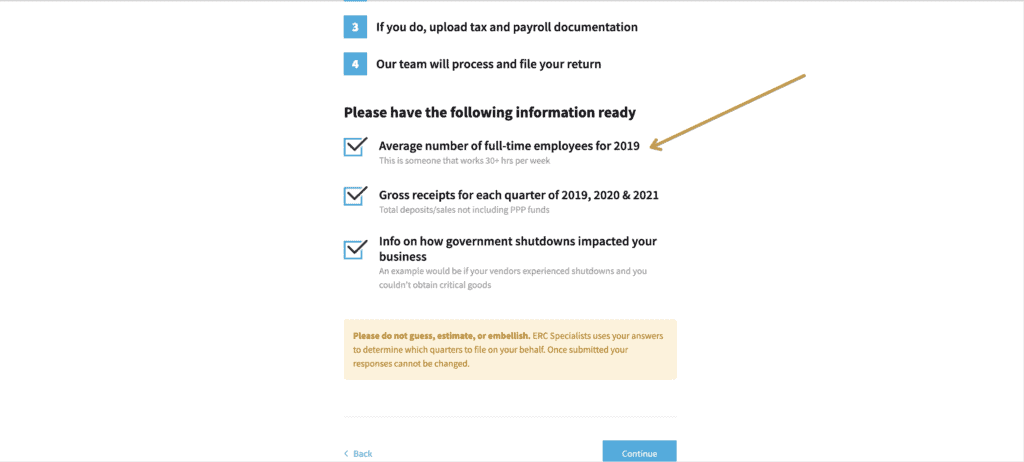

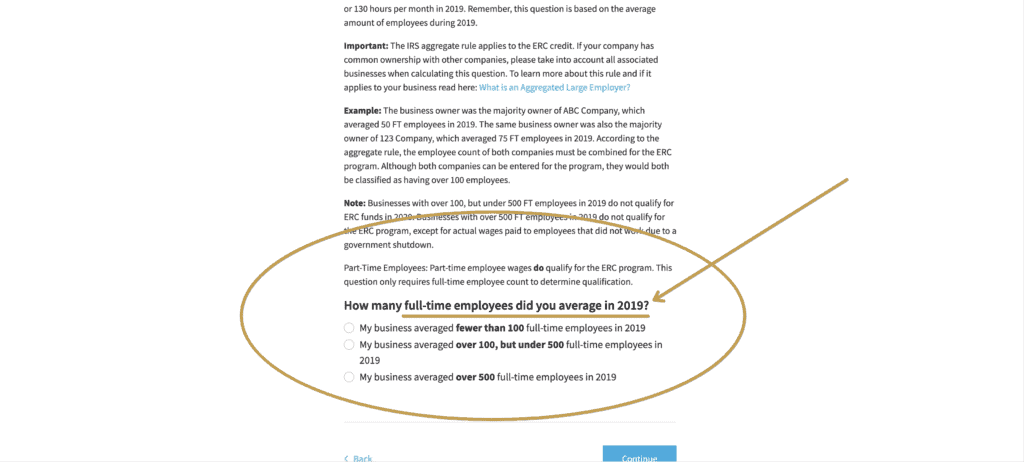

It’s going to prompt you to get some information together, including the average number of employees you had in 2019. That’s because the IRS compares everything to how your business was in the year 2019. Therefore, they compare 2020 to 2019 & 2021 to 2019 as well.

You also need to gather your gross receipts for the years of 2019, 2020, and 2021. This is specifically for the revenue reduction qualifier that we will get into later.

In terms of other items to pull together for your own records, any governmental shutdown orders and/or supply chain issues that impacted your business may come into play for ERC calculations. My recommendation is to make a list of vendor names and unavailable products, materials, and services that impacted your business during 2020 and 2021, along with any shutdown orders from your state, county, city, town, etc.

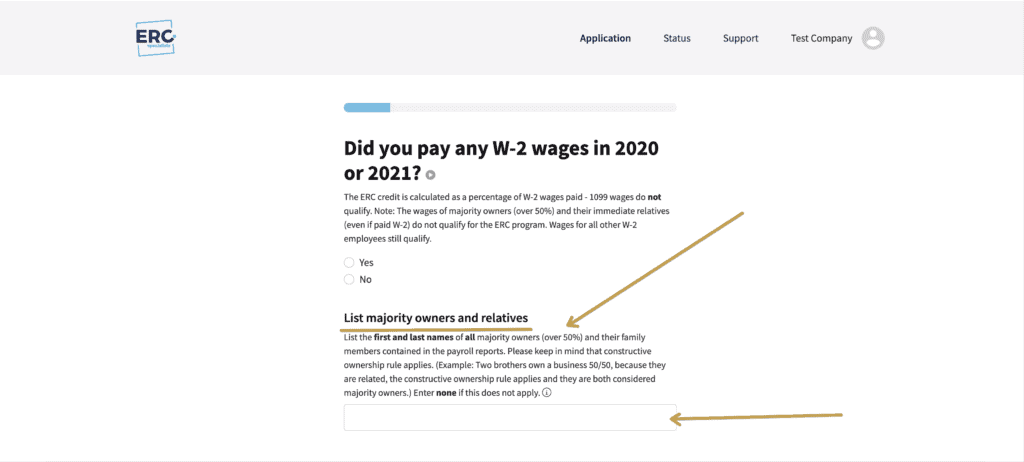

Moving on, the questionnaire straight up asks you, “Did you pay any W-2 wages in 2020 or 2021?” Unfortunately, ERC is not for 1099 employees, and you cannot receive ERC for people you paid with cash under the table.

Rather, the Employee Retention Credit is available for people you paid as W2 workers, which means you already paid payroll taxes and filed quarterly 941 forms with the IRS quarter. If that applies to you, go ahead and click “Yes”.

There are always exceptions to the rules, and ERC is no different. The IRS needs to know any majority owners of the business and their relatives. This means you need to list the names of anyone who owns 51% or more of the business, as well as the names of anyone in their family who works in the business paid as a W2 employee.

I get questions all the time such as, “What if I only own 50%?” Well, in that case you don’t own 51% or more, so you’re not considered a majority owner.

If you are a federal, state, or a local entity, then you are most likely excluded from this program. However, there are exceptions including some non-profits, churches, and tribal organizations.

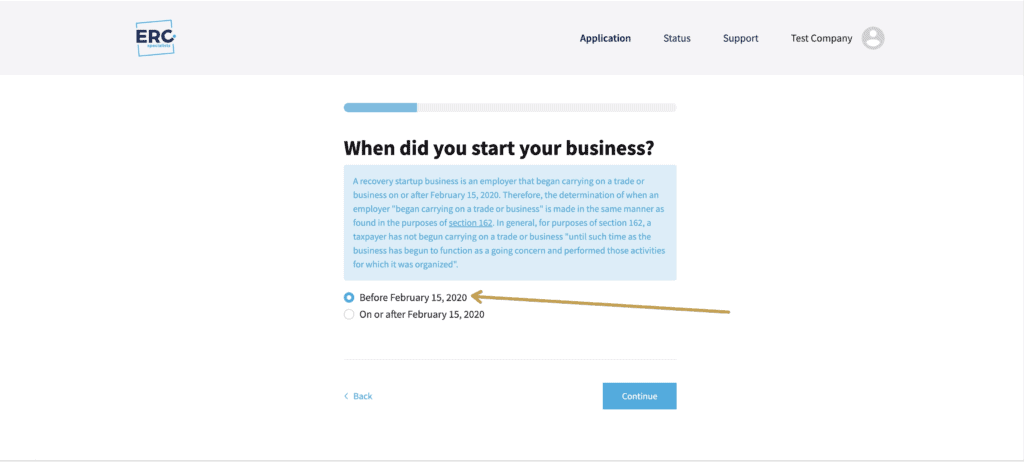

They need to know if you started your business before or after February 15th, 2020. If you started it after, then you are referred to as a “Recovery Startup Business” for the purposes of the ERC program.

They now need to to compare your business in 2021 and 2020 to your business in 2019, which is what the next several questions explore.

You need to select the category that applies to your business for number of full-time employees you had on average in 2019.

You might also like: Better Than PPP | Employee Retention Credit

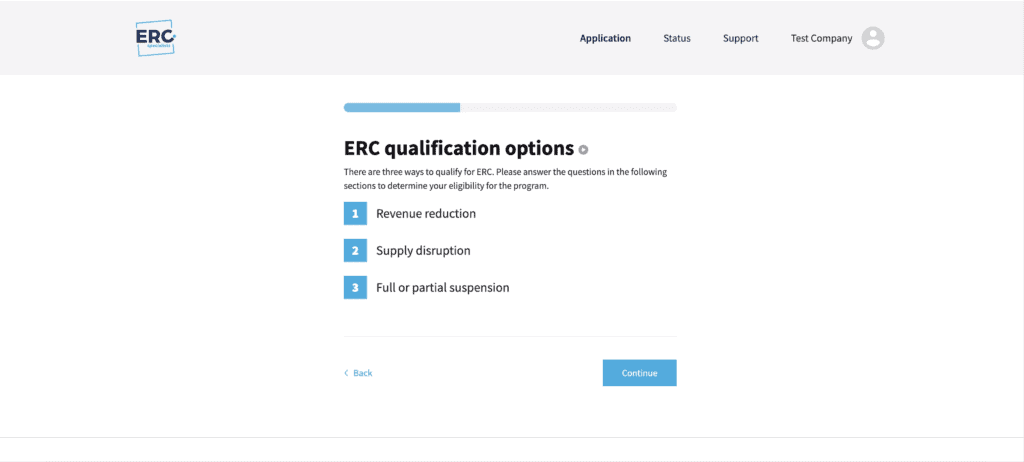

Above is an important screen because it addresses the three ERC qualification options – Revenue Reduction, Supply Chain Disruption, and Full or Partial Shutdown.

These three ERC qualifiers apply to six quarters: 2020 Q2, Q3, Q4 & 2021 Q1, Q2, Q3. If you experienced any (not all) of these qualifiers, you need to indicate that and state which quarters the qualifiers occurred in.

Let’s dive deep into each of the three ERC qualifiers …

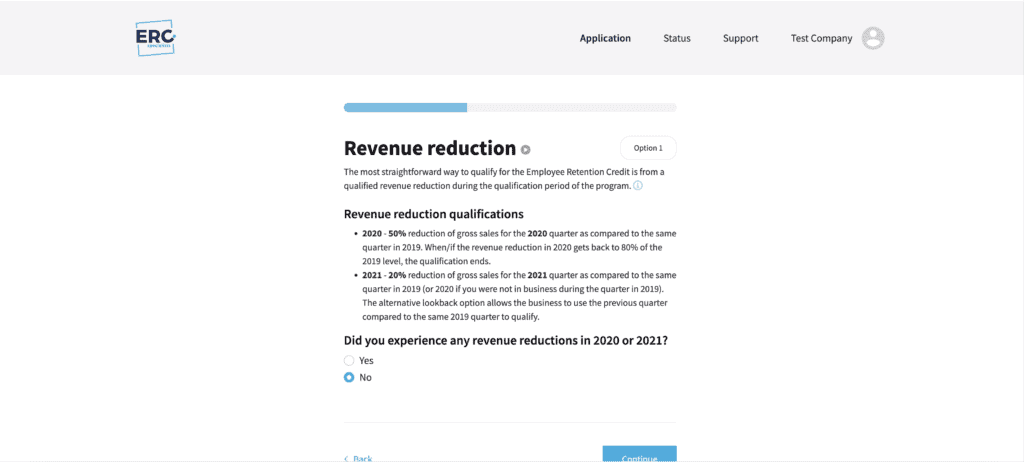

For Revenue Reduction, there are different criteria for 2020 and 2021. In 2020, if your gross receipts were down by more than 50% when compared to the same quarter in 2019, then you qualify for ERC. They were a bit more generous for 2021, so if your gross receipts were down by 20% or more when compared to the same quarter in 2019, then you again qualify.

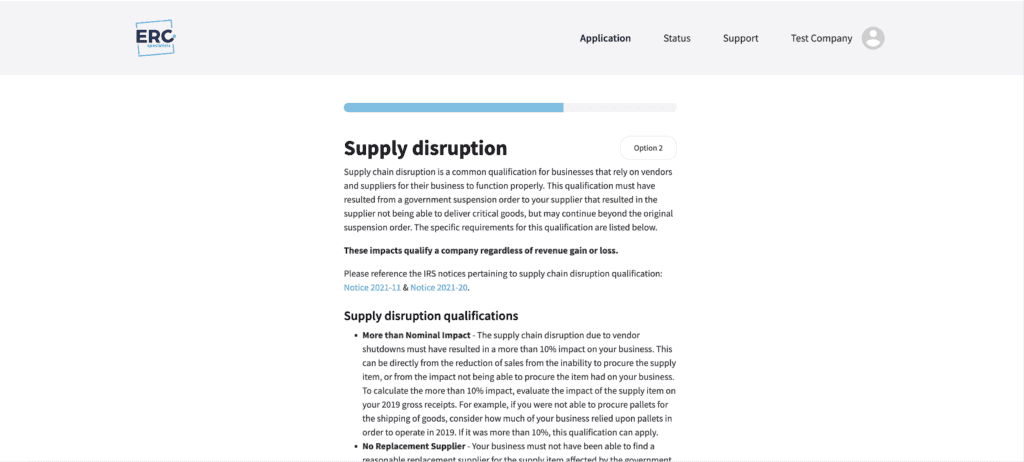

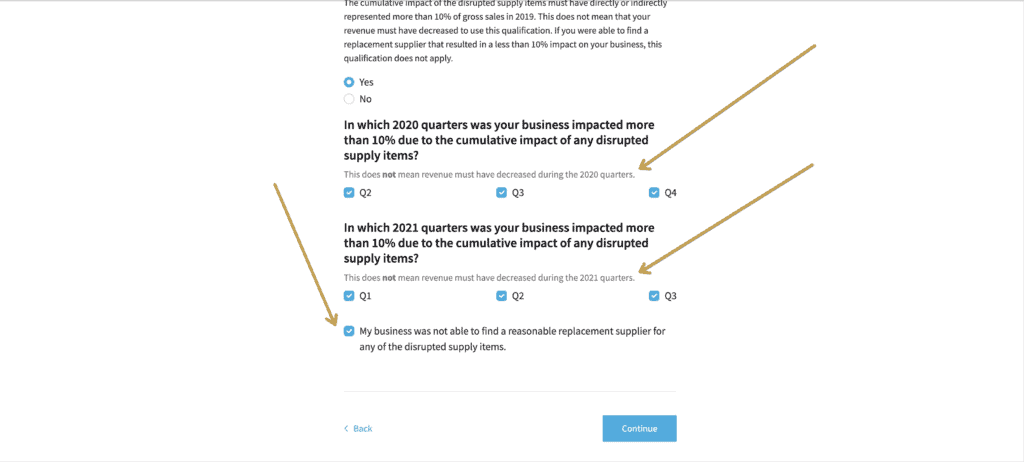

With Supply Chain Disruption, if you had trouble getting an important item for your business, such as a good, material, or a service that comprises 10% or more of your business, then you might qualify. They ask if you were able to find a reasonable replacement, so if that was the case then you probably wouldn’t qualify under Supply Chain Disruption because you still got what you needed.

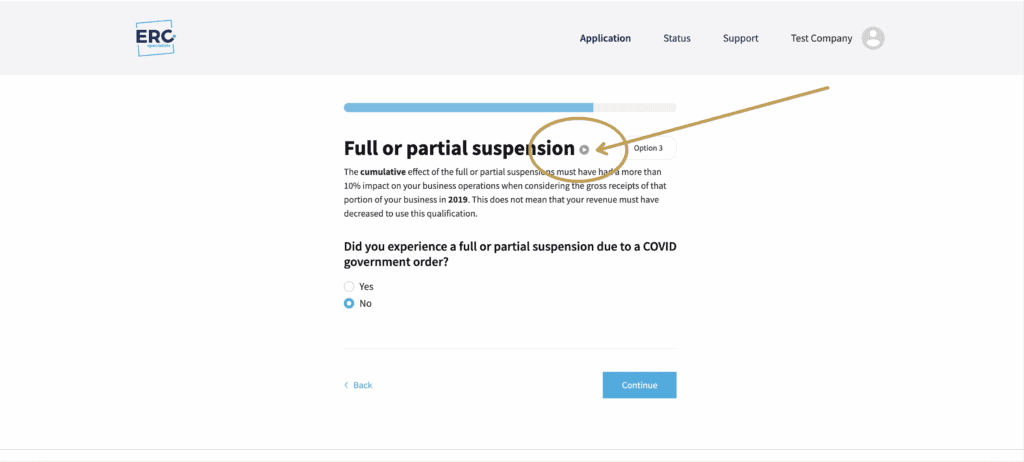

Full or Partial Shutdown means there was a governmental mandate to close or change the way you operate. For example, in some states they said, “You guys can stay open, but you can only have limited customers.” Therefore, if your business was shutdown anytime when those mandates were in place, then you can check the box for that quarter.

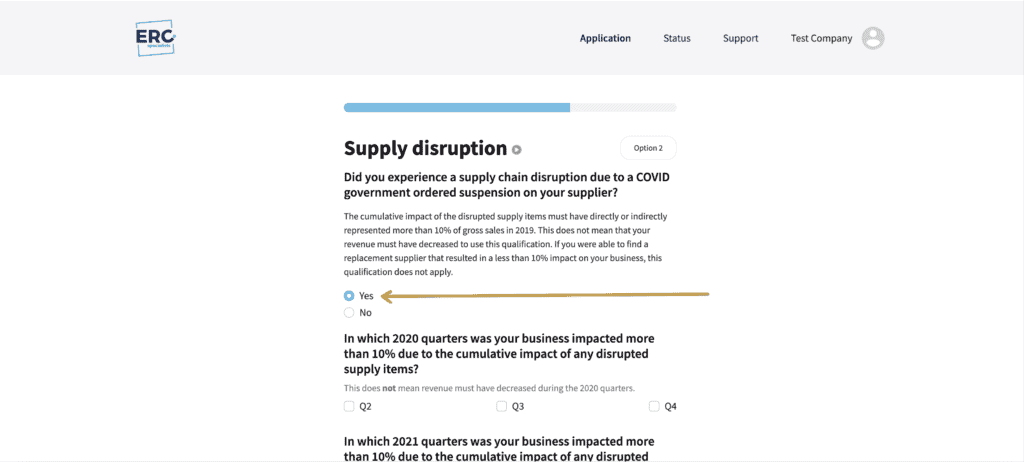

For the sake of this example questionnaire, I want to show people that you can still qualify even if you didn’t have a revenue reduction or weren’t fully shutdown due to some sort of governmental order.

As you can see, the qualifying questionnaire moves from questions about Revenue Reduction to a screen asking about Supply Chain Disruption. I want to point out that this questionnaire is adaptive. This means if I would’ve said “Yes” to having some sort of revenue reduction, then it would’ve asked me which quarters, but since I said “No” the application moves along to the next qualifier.

Go ahead and click the two links titled “Notice 2021-11” and “Notice 2021-20“. This is the IRS explanation of how Supply Chain Disruption applies to the Employee Retention Credit.

Let’s read this over together because it is something you’ll want to understand …

“Supply chain disruption is a common qualification for businesses that rely on vendors and suppliers for their business to function properly. This qualification must have resulted from a government suspension order to your supplier that resulted in the supplier not being able to deliver critical goods but may continue beyond the original suspension order.“

The scenario I use to explain Supply Chain Disruption is that if your supplier makes everything overseas, and they ship it through the port of New York City … but New York was in a state of emergency and the ports were closed down, then your supplier couldn’t get you your items. As a result, your business couldn’t function in the same way you did pre-pandemic, and there’s a good chance you qualify due to Supply Chain Disruption.

Again, there is one exception to the Supply Chain Disruption qualifier. If the item is something you could find a reasonable replacement supplier for, then you won’t qualify for ERC.

But what is a reasonable replacement supplier? From my understanding, it is going to be a supplier that can provide you with the exact same item.

I have a whole video dedicated to this topic that I recommend you watch. Remember, people had to change the way they did business, and, as a result, they couldn’t do business in the same way due to Supply Chain Disruption.

Supply Chain Disruption is a common qualifier, and no one knows your business better than you. You are best qualified to answer if your business had a Supply Chain Disruption.

As we continue with the Supply Chain Disruption qualifier, I am going to say yes for all six quarters. You also need to check the box that says “My business was not able to find a reasonable replacement supplier for any of the disrupted supply items.”

Now let’s move on to the section about Full or Partial Shutdown.

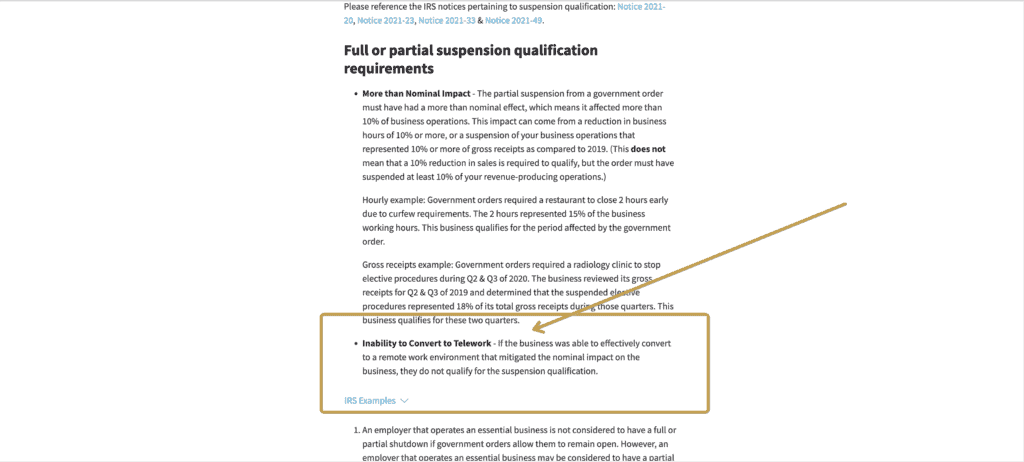

There are extensive lists of suspension orders that you can look up for your state and your category of business. The questionnaire gives you some IRS examples of what a full or partial shutdown looks like. For example, a restaurant that was able to do takeout but not sit down dining, or employers who were able to have a skeleton crew, but they weren’t able to do anything involving telecommuting such as Zoom or Google Meet.

If anything like that applied to your business, then go ahead and check “Yes” for Full or Partial Shutdown.

Before we move on, I want to mention that this qualifying questionnaire by ERC Specialists includes videos you can watch to get more information and clarification on certain terms or subjects. Click on the gray circle icon with a white triangle next to the title. Those videos can be really helpful!

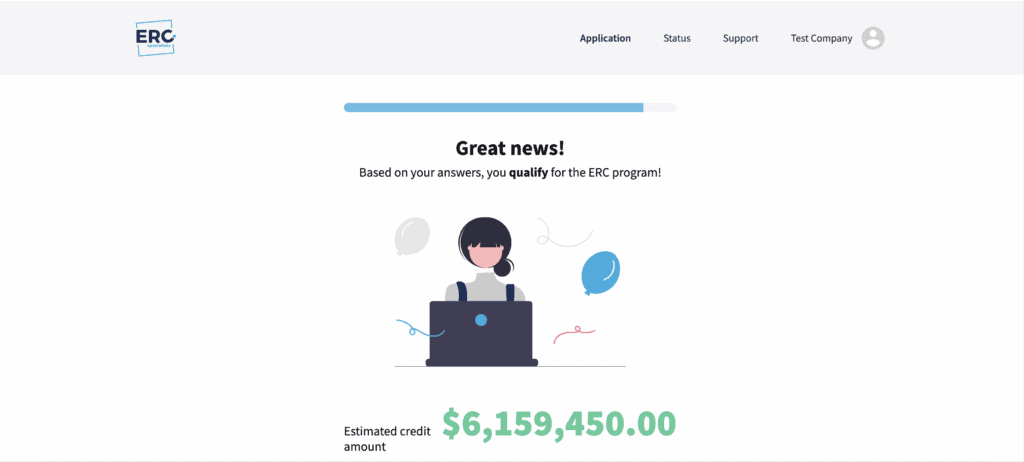

I clicked “No” for Full or Partial Shutdown, so then it says, “Congratulations! Based on your answers, you qualify for the following quarters!”

Related video content: Employee Retention Credit and PPP

Before we move on to uploading the required payroll documents, they need to confirm some information again – including on average how many W2 employees you had in 2020 and 2021.

Then you’re gonna see a screen that says, “Great news! Based on your answers, you qualify for the ERC program!“

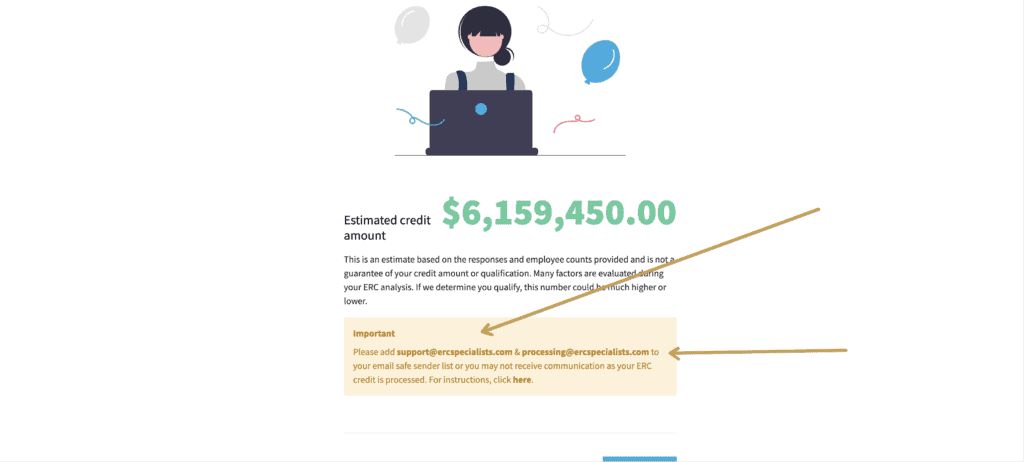

The Estimated Credit Amount is a best case scenario because they still need to take a look at your payroll documents. How much did you actually pay in wages? How many employees did you pay?

You are already off to a good start, but you need to upload those payroll documents now.

The questionnaire asks you to add two emails (support@ercspecialists.com & processing@ercspecialists.com) to your email safe sender list so nothing goes to spam.

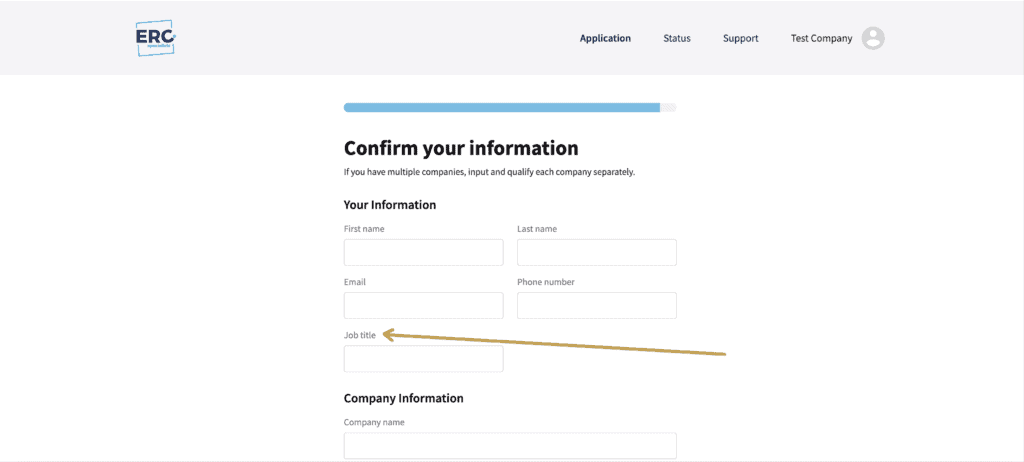

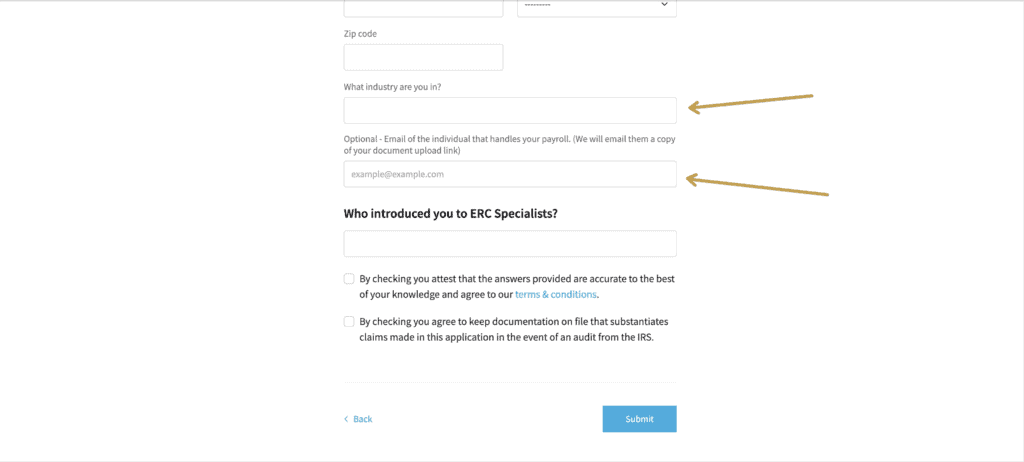

Then confirm all of your business information, including your job title, company name, address, industry, and if you want to include like an optional email address of someone that handles your payroll.

For this last part where it asks “Who introduced you to ERC Specialists?“, put my name Rich Smith. Throughout the years I’ve helped thousands of business owners learn about ERC, so I appreciate it if you specifically type in my name. If you put something like YouTube or The Internet, then it won’t get attached to me.

Finally, check the two boxes attesting to the truth of your answers and stating that you will keep documentation in case of potential IRS audits.

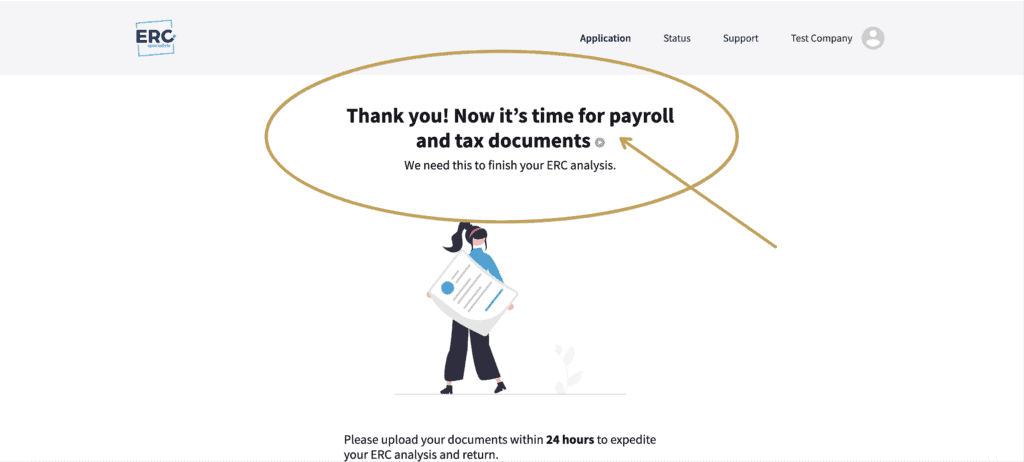

I recommend you upload the required payroll documents within 24 hours of filling out this ERC Qualifying Questionnaire.

I created a checklist for your reference that lists all of the documents you need to upload for ERC processing and filing, so check it out.

They ask if your business received a PPP loan (draw one, draw two, both, none). This is because they take out those wages later after they calculate your Employee Retention Credit. You’re not allowed to double dip the same government funds for the same purpose at the same time. In the end, they will exclude those funds from the ERC calculation.

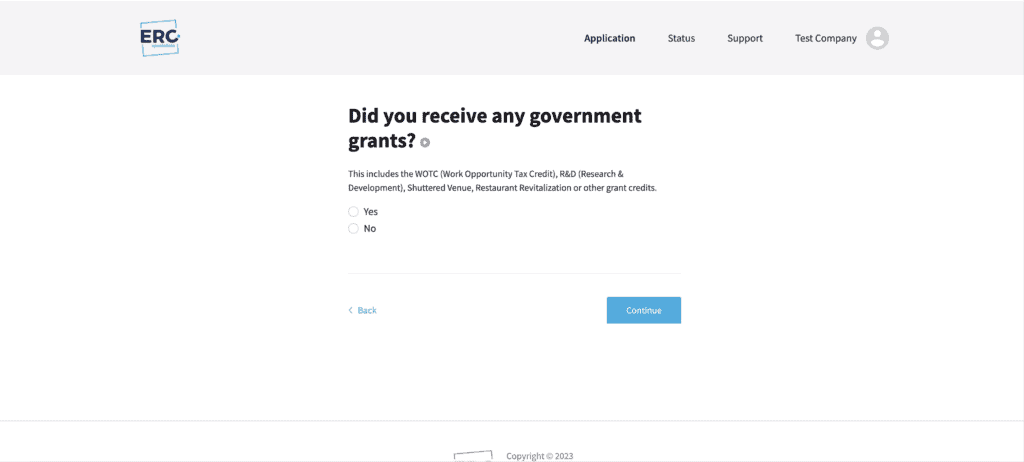

They also ask about any other government grants that your business may have received. Go ahead and select the answer that applies to you.

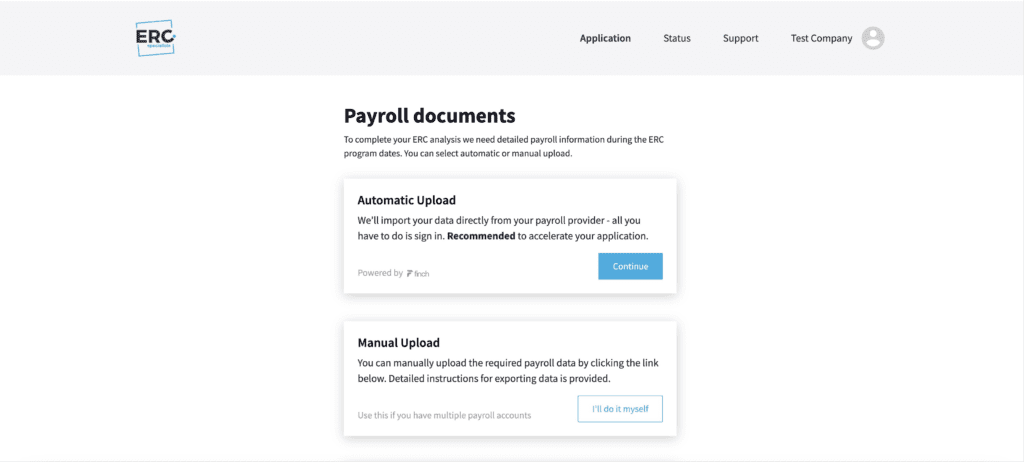

Now it’s time to either Manually Upload the required payroll documents, or they have an Automatic Upload option which imports your data from your payroll provider and is “Recommended to accelerate your application.“

I want to show you what an Automatic Upload looks like. If you’re familiar with Plaid or other types of services that can automatically link to your bank or payroll system, then this Automatic Upload works the same way.

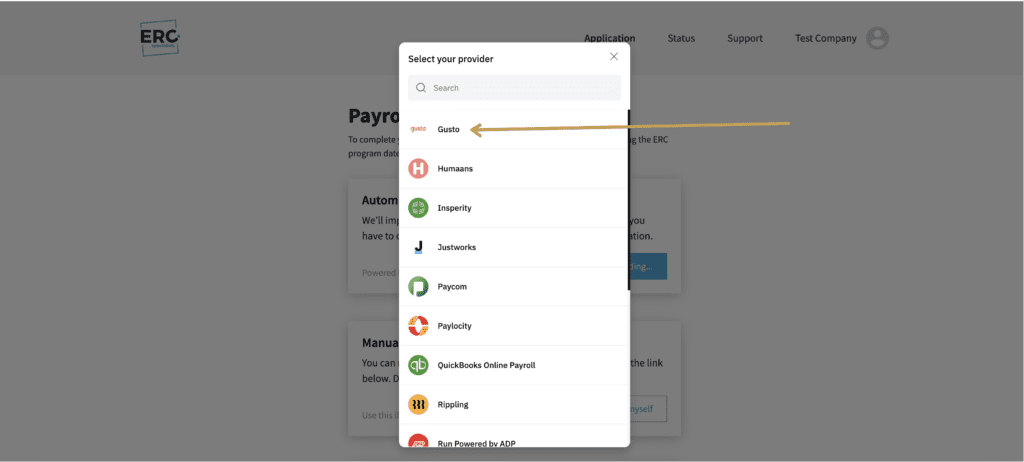

Click “Continue” and then select your payroll provider. Personally, I use Gusto for my own payroll – if you use Paychecks, ADP, or any of the big ones then you should be able to search for them, click connect, and then immediately upload everything without having to wait.

Can I get my ERC Funds faster?

As I said earlier, it is taking the IRS anywhere from 6-12 months to get Employee Retention Credits processed. There are several companies that are helping small businesses bridge the gap between applying for ERC and receiving their money with ERC Advances. You can read all about ERC Advance options in this post.

If your business needs the ERC funds quickly, an ERC Advance can be a great option.

Key Takeaways

I wanted to walk you through step-by-step how to fill out a free ERC Qualifying Questionnaire to see if your business qualifies for the Employee Retention Credit ERC. This is money that’s been around for a few years, but in the beginning nobody really knew about it. When people started to hear that there was a government program you could apply for retroactively, many thought it was too good to be true.

I’m telling you that it is real, and it takes the IRS on average around 6-12 months to get you ERC funds after you file. Remember, don’t pre-qualify or disqualify yourself … rather, take 5-10 minutes to fill out this free questionnaire to see how much you potentially could qualify for.

If you DO decide to file with ERC Specialists, there is going to be a success fee that’s due. They offer payment options of Pay Now or Pay Later.

My website is full of other resources about government programs, so please check it out.

As always, I’m Rich. Until next time.

Listen to Teaching Millionaires Podcast

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”