PPP Loan Based on Gross Income for Self Employed

Here’s a breakdown of how PPP Loan Based on Gross Income for Self Employed who file a Schedule C.

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

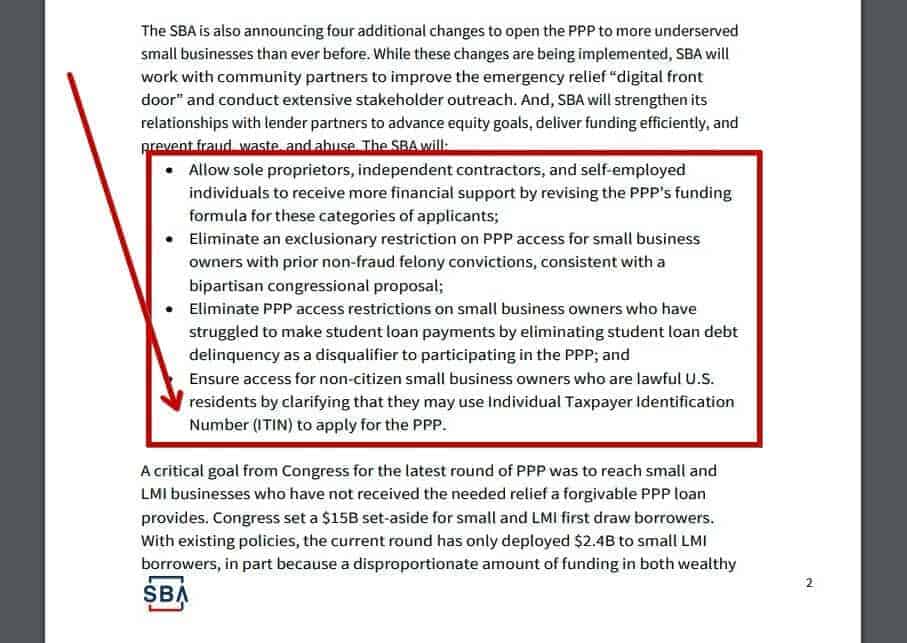

What are the New Changes to the PPP Loan?

On Wednesday, February 24, 2021, the White House released changes to the PPP guidelines. Keep in mind, this is a forgivable loan from the federal government aimed at helping small businesses … it does not need to be paid back when used properly. The self-employed, gig workers, and anyone who files a Schedule C tax form can apply.

The SBA is revising the formula used to calculate your maximum PPP loan amount. Previously, you had to use net income from Line 31 on your Schedule C. However, gross income from Line 7 will now be used to calculate PPP loan amounts.

This is a major change because gross income means all the money you’ve earned before taking tax deductions. Many can expect higher PPP loan amounts. I’ve created a new Gross Income PPP Loan Amount Calculator to help you determine the amount you can expect.

Are PPP Funds Still Available?

I encourage small business owners who might be thinking this doesn’t apply to you—housecleaners, Uber and DoorDash drivers, artists, actors, and anyone with a side hustle—consider applying because these funds are there to help you.

Remember, when used properly this money does not need to be paid back.

What are the New Guidelines for the PPP Loan Based on Gross Income for Self Employed?

There is a dedicated period for small business owners to apply who have less than 20 employees. The SBA will exclusively process these types of applications for 14 consecutive calendar days. The two-week window started on February 24, 2021 and goes until March 9, 2021.

The pool of acceptable applicants has grown as well. For example, if you have a felony conviction not related to fraud, then you can apply for a PPP loan. Also, those who are not U.S. citizens but have a valid ITIN Individual Taxpayer Identification Number can apply too.

Are PPP Funds Still Available Today?

As of February 21, 2021, more than half or $143 billion is still available for this round of PPP funding. If you are thinking about applying, I recommend getting your documentation ready. A PDF file of your 2019 tax documents will be necessary.

You need to apply through a SBA-approved lender. You can contact your local community bank to see if they’re accepting applications. I’ve partnered with Womply—a software company who is trying to fast track PPP applications.

When Will the New Guidelines for the PPP Loan Change?

The SBA works slower than we want. They’re trying to process loans while also making sure people aren’t committing fraud. Right now, the SBA is stalled on the gross income rules and new application.

We’re also getting mixed messages about those who’ve already applied for PPP loans. Will they be able to reapply and get the larger gross loan amount? Some are saying no. However, the SBA allowed farmers to adjust their loan amounts using gross income.

Still, over 40 million small businesses with zero employees have not yet applied for their first PPP loan. With these new rules, you could get anywhere from a few thousand dollars up to $20,833—twice.

My second recommendation is to open a brand-new free bank account to help separate your personal/business transactions from this PPP money. SoFi Bank gives you $50 free when you open an account. While this is not a necessity, I want you to keep PPP funds separate and have crystal clear documentation.

Once approved, you can expect the funds be deposited after 10 days or so. I have other articles on how to “pay yourself” these funds as owner’s compensation, and I promise to update this post and make YouTube videos as soon as these changes are in place.

Those of you who already applied for First Draw PPP and/or Second Draw PPP, I am hopeful that the SBA will allow lenders to let you request more money using gross income. You can sign-up for my newsletter, and I’ll send out an email as soon as we know more.

As always, I’m Rich and until next time.

Listen to Teacher Millionaires Podcast

“TeachingMillionaires.com has partnered with CardRatings for our coverage of credit card products. TeachingMillionaires.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. I am not a financial advisor. The information I share is for educational purposes only and shouldn’t be considered as certified financial or legal advice. It is imperative you conduct your own research. I am sharing my opinion only.”

Hello, my name is Tammy. I was wondering if you could help me please? I got my first draw for the PPP loan deposited into my account on April 20th. My schedule C (2019 taxes) shows 70,964 for line 7 but somehow, the underwriter more than doubled that amount on my application for the amount of

$164.004, which is incorrect and gave me MORE loan money than what I’m qualified for. My loan amount should have only been for $14,000+ BUT $20,833 was deposited into my bank account. I don’t know who did the calculations. I applied through Womply. Harvest was my lender. At this point I really don’t know what to do. Do I send the overpayment amount back? Do I send the whole amount back? Please help me

Tammy, I’m hearing this more and more. Will you email me? I want to find out why this is happening.

Hello, thanks for all the information you have provided. I really appreciate it. Using your formula if I did it right, (line 7 on schedule C times 2.5), my husband received $537.50 more than he should have. Should he deduct this amount, divide the remainder and pay himself that over the 10 weeks and use the remaining $537.50 towards business expenses or just not spend that amount and try to return it to still qualify for forgiveness. He applied as sole proprietor, no employees. Thanks in advance for any assistance you can provide.

Yes, the calculation should be based off the correct Line 7 amount on the Schedule C.